Question: PLEASE SHOW THE WORK... I NEED TO UNDERSTAND AND NOT COPY To more efficiently manage its inventory. Treynor Corporation maintains its internal inventory records using

PLEASE SHOW THE WORK... I NEED TO UNDERSTAND AND NOT COPY

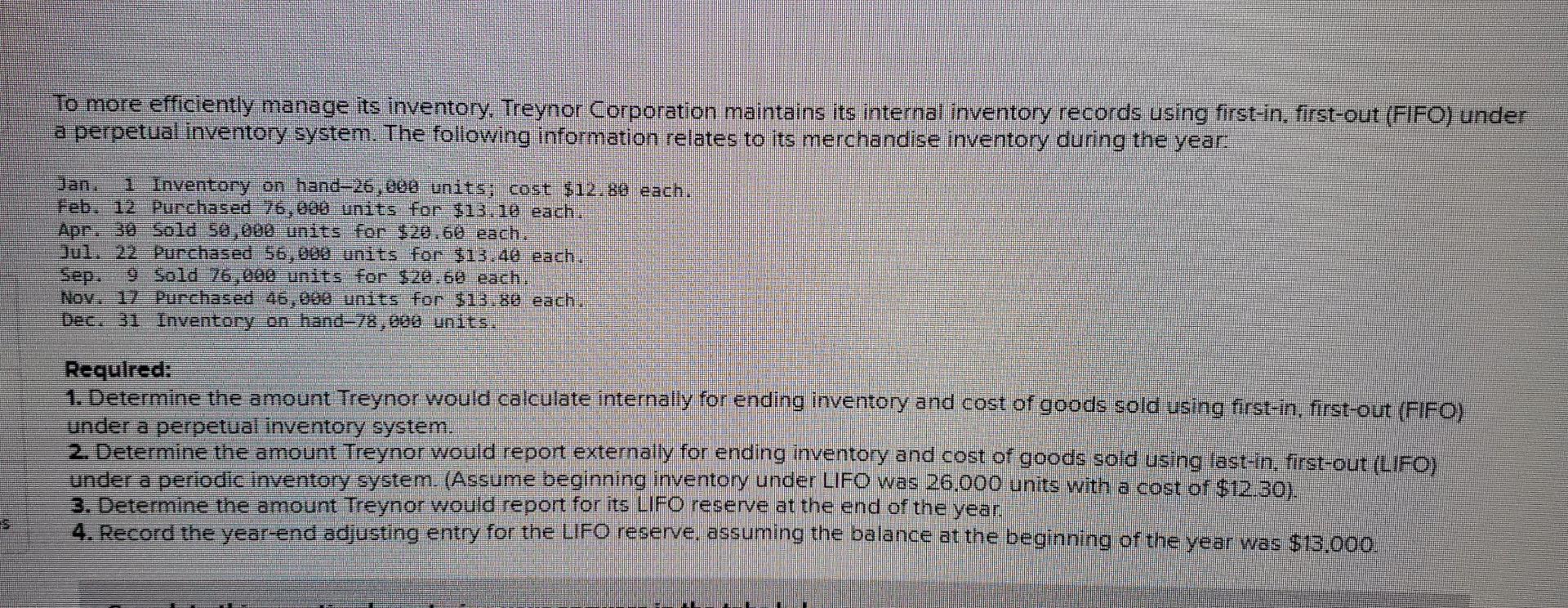

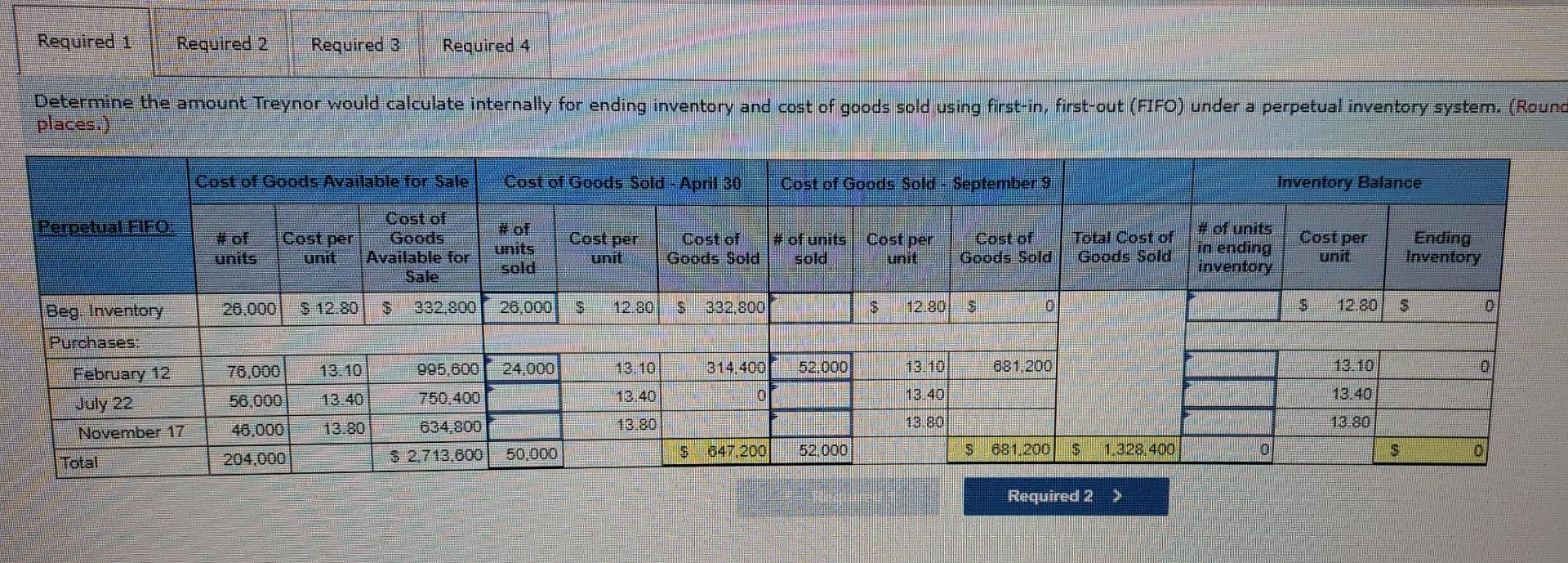

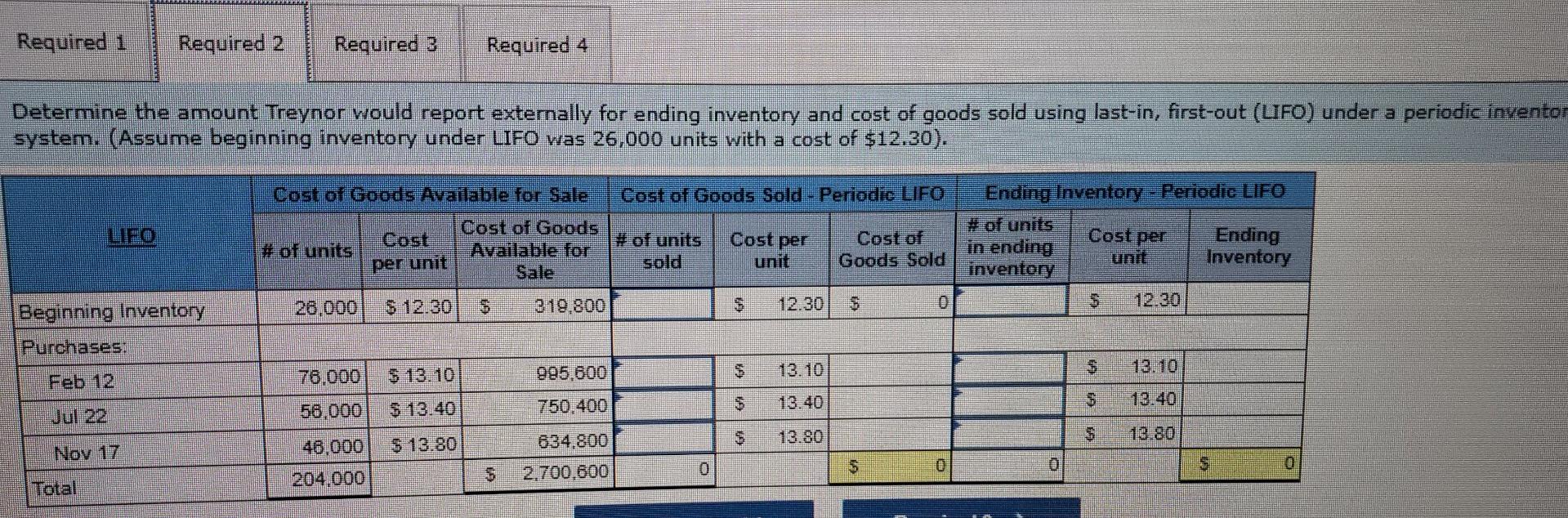

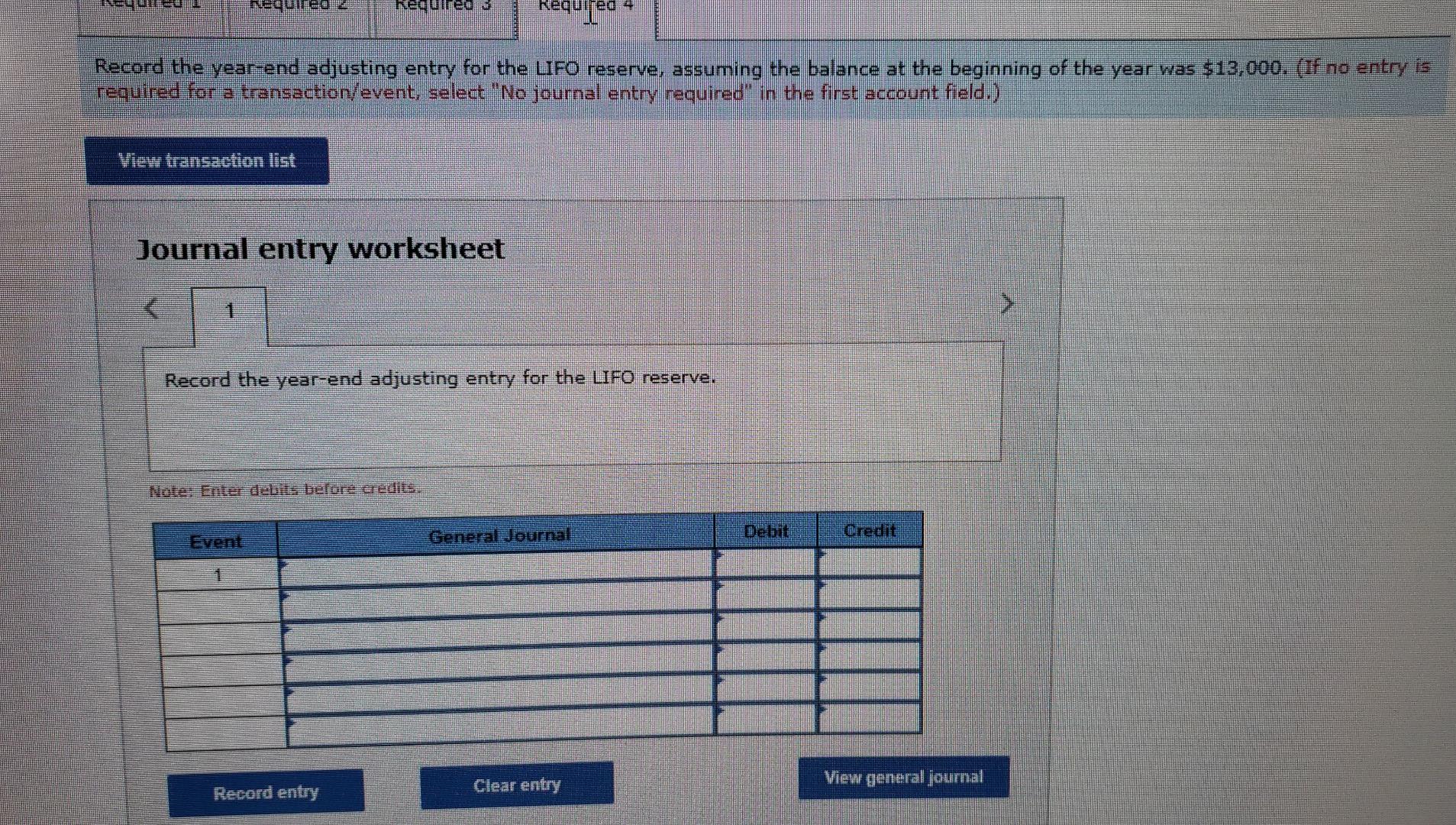

To more efficiently manage its inventory. Treynor Corporation maintains its internal inventory records using first-in. first-out (FIFO) under a perpetual inventory system. The following information relates to its merchandise inventory during the year. 1 Inventory on hand-26,800 units; cost $12.80 each. Feb. 12 Purchased 76, 800 units for $13.10 each. Apr. 30 Sold 50,000 units for $28.60 each. Jul 22 Purchased 56,600 units for $13.40 each. 9 Sold 76, 800 units for $28.60 each. Nov. 17 Purchased 46. 000 units for $13.80 each. Dec. 31 Inventory on hand-78,000 units. Required: 1. Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. 2. Determine the amount Treynor would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. (Assume beginning inventory under LIFO was 26.000 units with a cost of $12.30). 3. Determine the amount Treynor would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $13,000. Required 1 Required 2 Required 3 Required 4 Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. (Round places.) Cost of Goods Available for Sale Cost of Goods Sold - April 30 Cost of Goods Sold - September 9 Inventory Balance Perpetual FEO Cost per Cost per Cost per Cost per Cost of Goods Available for Sale # of units sold Cost of Goods Sold # of units sold Cost of Goods Sold Total cost of Goods Sold # of units in ending inventory Ending Inventory unit unit unit 26.000 Beg. Inventory $ 12.80 332.800 26,000 $ 12.80 $ 332,800 12.90 0 12.80 Purchases: 76.000 13.10 995.600 24.000 13.10 314.400 52,000 13.10 681,200 13.10 February 12 July 22 56,000 13:40 750.400 13.40 13.40 12.40 13.80 November 17 634.800 13.80 13.80 13.80 46.000 204,000 52000 647 200 50,000 $ $ 881.200 $ 2,713,800 1.328.400 Total 0 Required 2 > Required 1 Required 2 Required 3 Required 4 Determine the amount Treynor would report extemally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventor system. (Assume beginning inventory under LIFO was 26,000 units with a cost of $12.30). Cost of Goods Available for Sale Cost of Goods Sold - Periodic LIFO LIFO Cost Ending Inventory - Periodic LIFO # of units Cost per Ending in ending unit Inventory inventory Cost per Cost of Goods Available for Sale # of units # of units sold Cost of Goods Sold per unit unit 28.000 $ 12.30 $ 319.800 S 12.30 $ 10 Beginning Inventory Purchases: 995.600 $ 76.000 $ $ 13.10 13.10 13.10 Feb 12 58.000 $ 13.40 750.400 13.40 13.40 $ 13.80 13.80 Nov 17 $ 13.80 46,000 634,800 2.700.600 $ 0 0 TE 0 $ 204.000 Total Complete this ques Required 1 Required 2 Required 4 Required 3 Determine the amount Treynor would report for its LIFO reserve at the end of the year. UFO Reserve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts