Question: Please show the work in Excel . 16 Score 0 Consider a property investment that you finance with 20% down payment. For the remaining, you

Please show the work in Excel

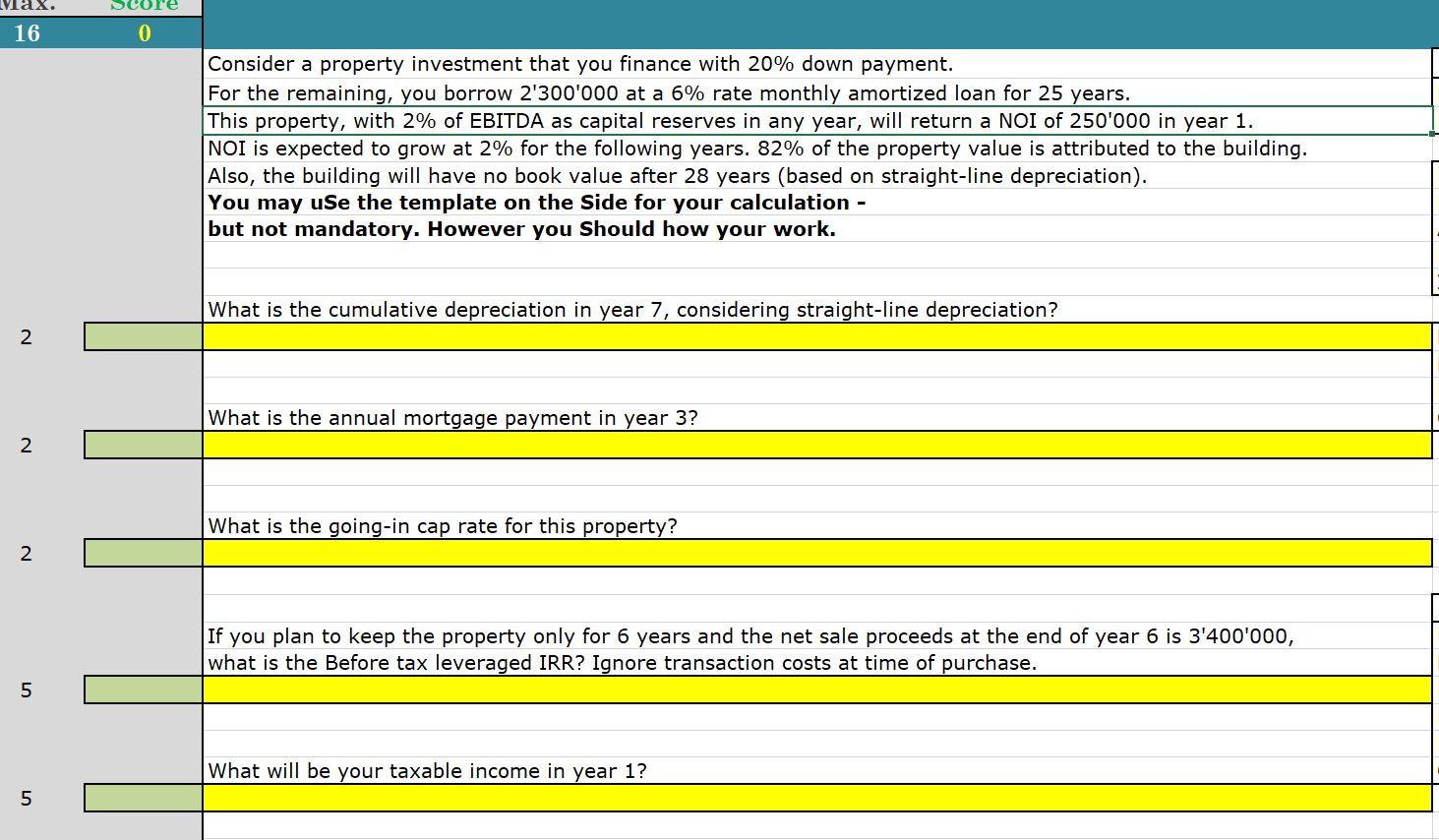

. 16 Score 0 Consider a property investment that you finance with 20% down payment. For the remaining, you borrow 2'300'000 at a 6% rate monthly amortized loan for 25 years. This property, with 2% of EBITDA as capital reserves in any year, will return a NOI of 250'000 in year 1. NOI is expected to grow at 2% for the following years. 82% of the property value is attributed to the building. Also, the building will have no book value after 28 years (based on straight-line depreciation). You may use the template on the side for your calculation - but not mandatory. However you Should how your work. What is the cumulative depreciation in year 7, considering straight-line depreciation? 2 What is the annual mortgage payment in year 3? 2 What is the going-in cap rate for this property? 2 If you plan to keep the property only for 6 years and the net sale proceeds at the end of year 6 is 3'400'000, what is the Before tax leveraged IRR? Ignore transaction costs at time of purchase. 5 What will be your taxable income in year 1? 5 . 16 Score 0 Consider a property investment that you finance with 20% down payment. For the remaining, you borrow 2'300'000 at a 6% rate monthly amortized loan for 25 years. This property, with 2% of EBITDA as capital reserves in any year, will return a NOI of 250'000 in year 1. NOI is expected to grow at 2% for the following years. 82% of the property value is attributed to the building. Also, the building will have no book value after 28 years (based on straight-line depreciation). You may use the template on the side for your calculation - but not mandatory. However you Should how your work. What is the cumulative depreciation in year 7, considering straight-line depreciation? 2 What is the annual mortgage payment in year 3? 2 What is the going-in cap rate for this property? 2 If you plan to keep the property only for 6 years and the net sale proceeds at the end of year 6 is 3'400'000, what is the Before tax leveraged IRR? Ignore transaction costs at time of purchase. 5 What will be your taxable income in year 1? 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts