Question: Please show the work in excel format!!! Task 2: Weighted Average Cost of Capital (WACC) You are given the following information for Full Moon, Inc.:

Please show the work in excel format!!!

Please show the work in excel format!!!

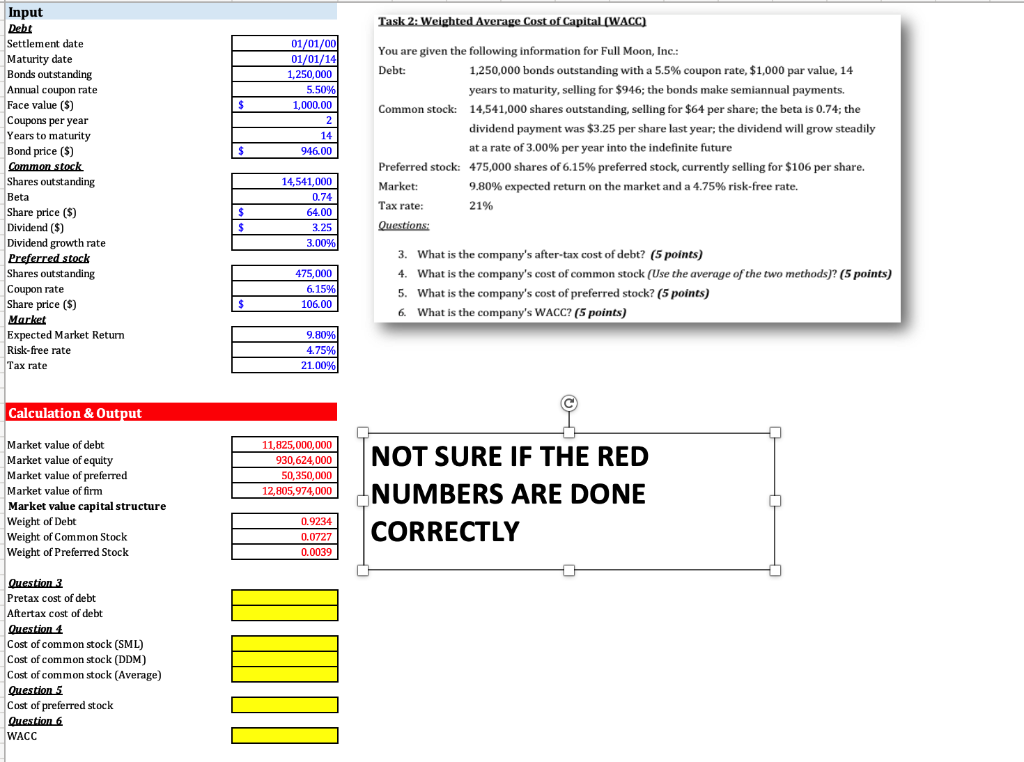

Task 2: Weighted Average Cost of Capital (WACC) You are given the following information for Full Moon, Inc.: Debt: 1,250,000 bonds outstanding with a 5.5% coupon rate, $1,000 par value, 14 years to maturity, selling for $946; the bonds make semiannual payments. Common stock: 14,541,000 shares outstanding, selling for $64 per share; the beta is 0.74 ; the dividend payment was $3.25 per share last year; the dividend will grow steadily at a rate of 3.00% per year into the indefinite future Preferred stock: 475,000 shares of 6.15% preferred stock, currently selling for $106 per share. Market: 9.80% expected return on the market and a 4.75% risk-free rate. Tax rate: 21% Questions: 3. What is the company's after-tax cost of debt? (5 points) 4. What is the company's cost of common stock (Use the average of the two methods)? (5 points) 5. What is the company's cost of preferred stock? (5 points) 6. What is the company's WACC? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts