Question: please show the work in excel sheet, also show the formula, please As indicated in the above example, during the first five years of operation,

please show the work in excel sheet, also show the formula, please

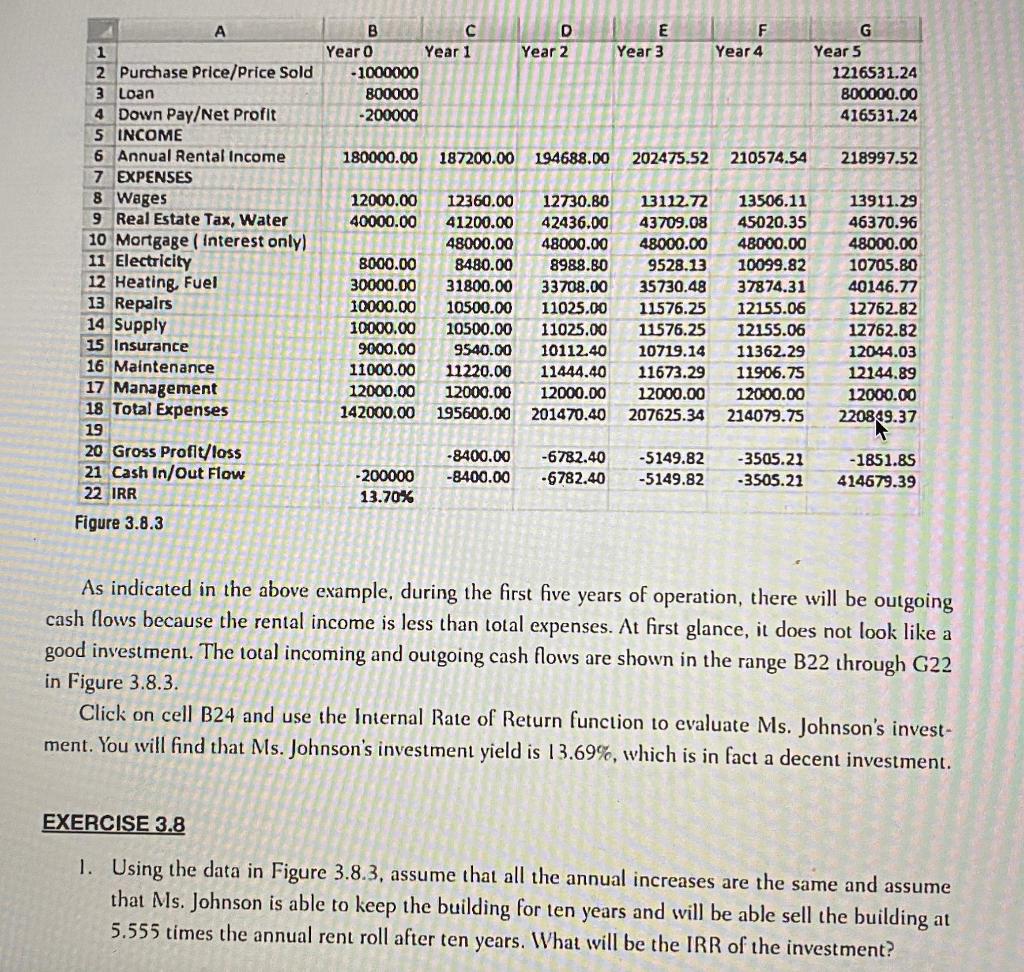

As indicated in the above example, during the first five years of operation, there will be outgoing cash flows because the rental income is less than total expenses. At first glance, it does not look like a good investment. The total incoming and outgoing cash flows are shown in the range B22 through G22 in Figure 3.8.3. Click on cell B24 and use the Internal Rate of Return function to evaluate Ms. Johnson's investment. You will find that Ms. Johnson's investment yield is 13.69%, which is in fact a decent investment. EXERCISE 3.8 1. Using the data in Figure 3.8.3, assume that all the annual increases are the same and assume that Ms. Johnson is able to keep the building for ten years and will be able sell the building at 5.555 times the annual rent roll after ten years. What will be the IRR of the investment? As indicated in the above example, during the first five years of operation, there will be outgoing cash flows because the rental income is less than total expenses. At first glance, it does not look like a good investment. The total incoming and outgoing cash flows are shown in the range B22 through G22 in Figure 3.8.3. Click on cell B24 and use the Internal Rate of Return function to evaluate Ms. Johnson's investment. You will find that Ms. Johnson's investment yield is 13.69%, which is in fact a decent investment. EXERCISE 3.8 1. Using the data in Figure 3.8.3, assume that all the annual increases are the same and assume that Ms. Johnson is able to keep the building for ten years and will be able sell the building at 5.555 times the annual rent roll after ten years. What will be the IRR of the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts