Question: Please show the working Question 3 (9 marks) The following market data are available Spot rate of NZ dollar: US$0.74 (US$/NZS) One-year call option: Exercise

Please show the working

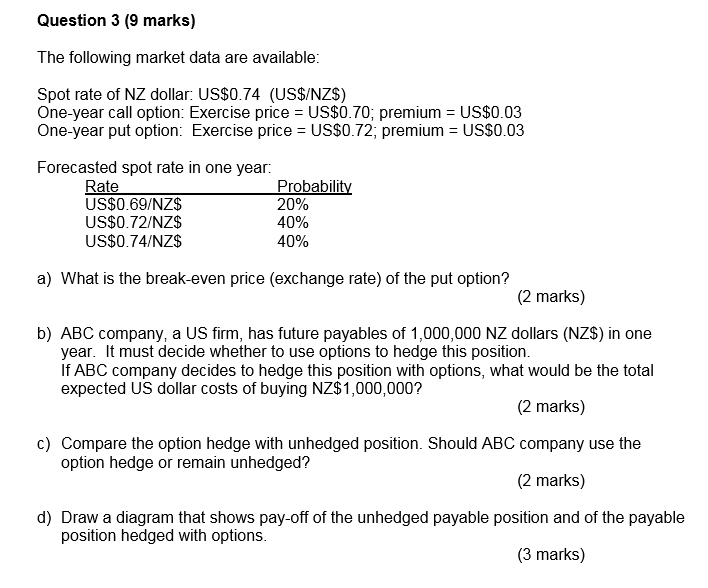

Question 3 (9 marks) The following market data are available Spot rate of NZ dollar: US$0.74 (US$/NZS) One-year call option: Exercise price = US$0.70, premium = US$0.03 One-year put option: Exercise price = US$0.72, premium-US$0.03 Forecasted spot rate in one year: US$0.69/NZS USSO.72/NZ$ US$O.74/NZS Probabilit 20% 40% 40% a) What is the break-even price (exchange rate) of the put option? (2 marks) b) ABC company, a US firm, has future payables of 1,000,000 NZ dollars (NZS) in one year. It must decide whether to use options to hedge this position If ABC company decides to hedge this position with options, what would be the total expected US dollar costs of buying NZ$1,000,000? (2 markS) c) Compare the option hedge with unhedged position. Should ABC company use the option hedge or remain unhedged? (2 marks) d) Draw a diagram that shows pay-off of the unhedged payable position and of the payable position hedged with options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts