Question: please show the work/process to get the final result 9. (5 pt.) On April 1, 2022, Prince Company pledges $800,000 of its accounts receivable to

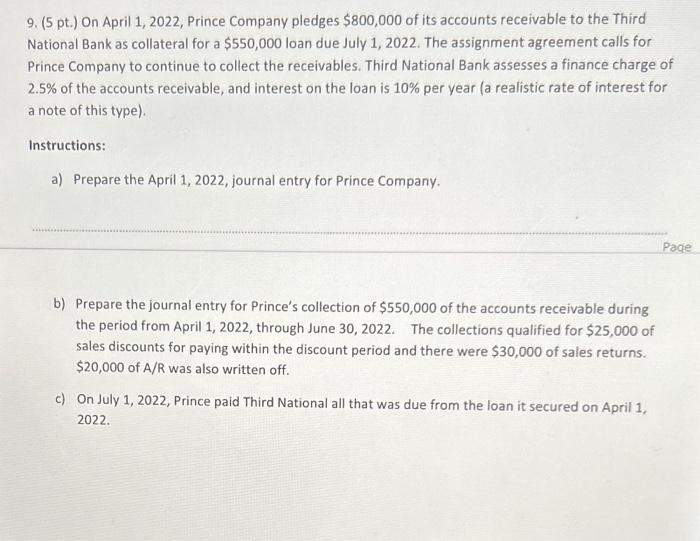

9. (5 pt.) On April 1, 2022, Prince Company pledges $800,000 of its accounts receivable to the Third National Bank as collateral for a $550,000 loan due July 1,2022 . The assignment agreement calls for Prince Company to continue to collect the receivables. Third National Bank assesses a finance charge of 2.5% of the accounts receivable, and interest on the loan is 10% per year (a realistic rate of interest for a note of this type). Instructions: a) Prepare the April 1, 2022, journal entry for Prince Company. b) Prepare the journal entry for Prince's collection of $550,000 of the accounts receivable during the period from April 1, 2022, through June 30, 2022. The collections qualified for $25,000 of sales discounts for paying within the discount period and there were $30,000 of sales returns. $20,000 of A/R was also written off. c) On July 1,2022 , Prince paid Third National all that was due from the loan it secured on April 1 , 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts