Question: please show this is excel; i need to learn the layout of how to show cash flows. do you hust use income statement format? Question:

please show this is excel; i need to learn the layout of how to show cash flows. do you hust use income statement format?

Question:

Igors Ice Cream business is struggling, and he is hoping that marketing new flavors will help him. For an additional one-time $2,000 in marketing costs, Igor is hoping for a boost in sales.

The new marketing should boost his sales by 7% next year, 15% in year 2, 7% in year 3, 3% in year 4, and be obsolete after 4 years. Igor doesn't expect any salvage value from his marketing materials.

If Igor pursues this plan, his current assets are projected to increase from $4,750 to $10,370 and his current liabilities are projected to decrease from $1,580 to $748.

Variable costs will continue to be 35% of sales.

Practice Cash Budgeting by:

1) Create a 4-year schedule of cash flows for Igor.

Calculate the expected 2) NPV, 3) IRR, and 4) MIRR of this marketing plan if Igor expects to pay for it using existing cash-on-hand (with a cost of capital of 7.7%)

Calculate the expected 5) NPV, 6) IRR, and 7) MIRR of this marketing plan if Igor instead uses his line of credit at 3.5%

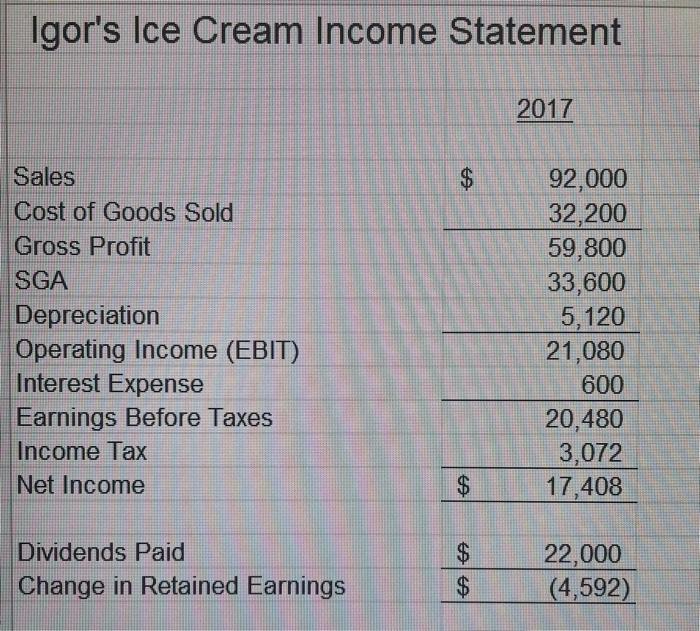

Igor's Ice Cream Income Statement 2017 \begin{tabular}{lrr} Sales & $ & 92,000 \\ Cost of Goods Sold & & 32,200 \\ Gross Profit & & 59,800 \\ SGA & 33,600 \\ Depreciation & 5,120 \\ Operating Income (EBIT) & 21,080 \\ Interest Expense & 600 \\ Earnings Before Taxes & 20,480 \\ Income Tax & 3,072 \\ \hline Net Income & $ & 17,408 \\ \hline & & \\ Dividends Paid & $ & 22,000 \\ Change in Retained Earnings & $ & (4,592) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts