Question: Please show typed solutions/explanations/workings. DO NOT POST EXCEL SCREENSHOTS! 1. Comprehensive: Balance Sheet from Statement of Cash Flows Mills Company prepared the following balance sheet

Please show typed solutions/explanations/workings. DO NOT POST EXCEL SCREENSHOTS!

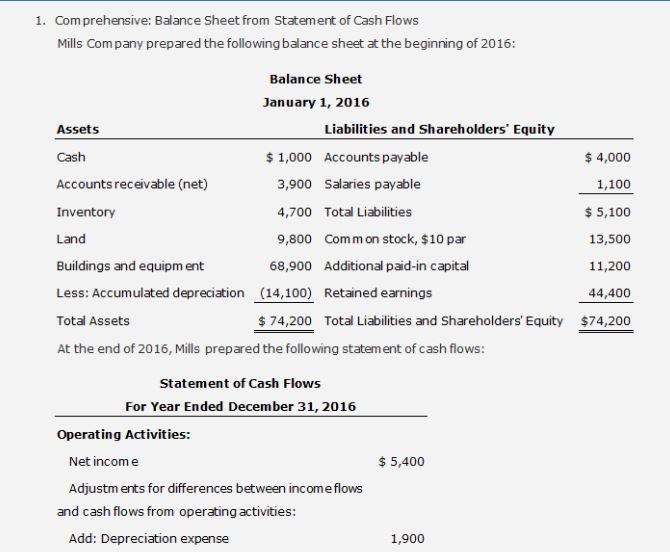

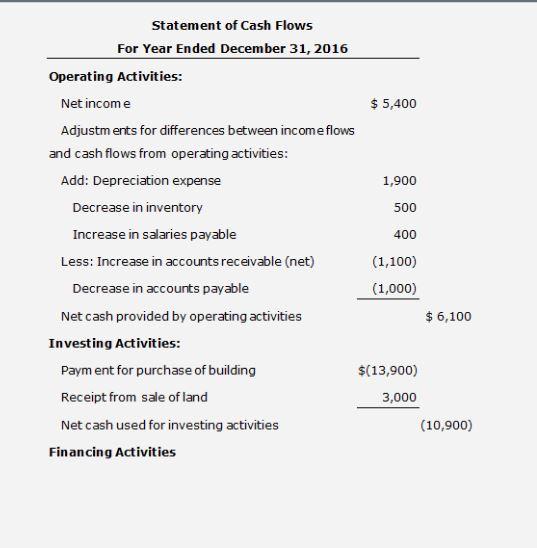

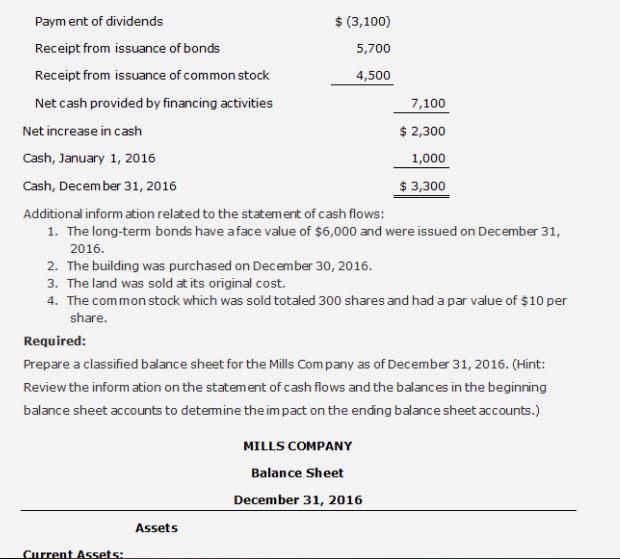

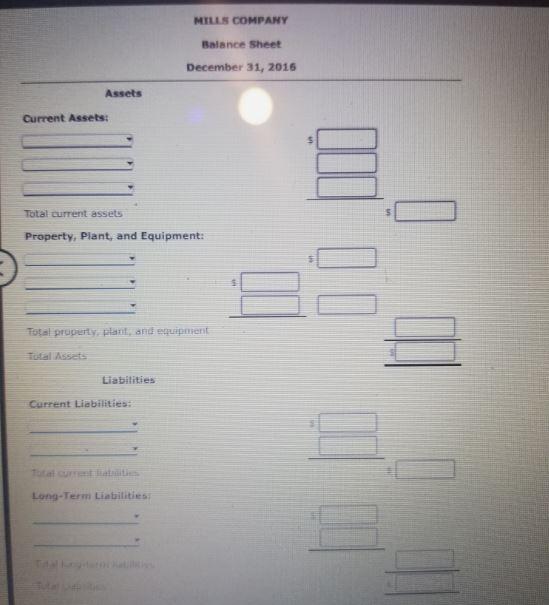

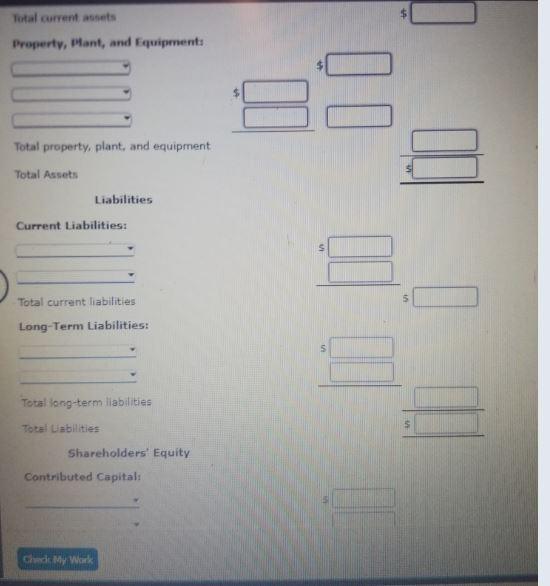

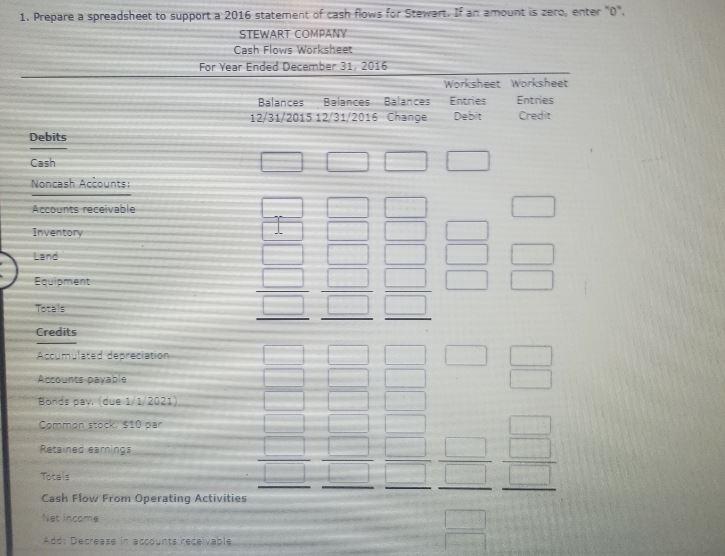

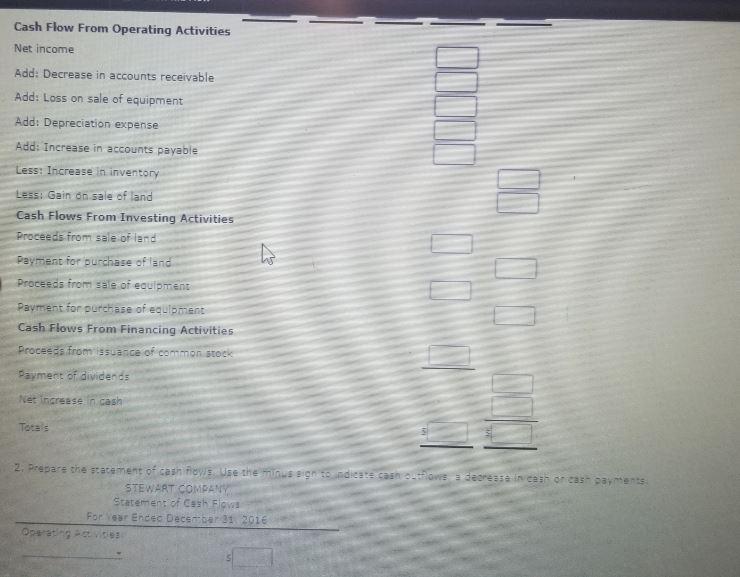

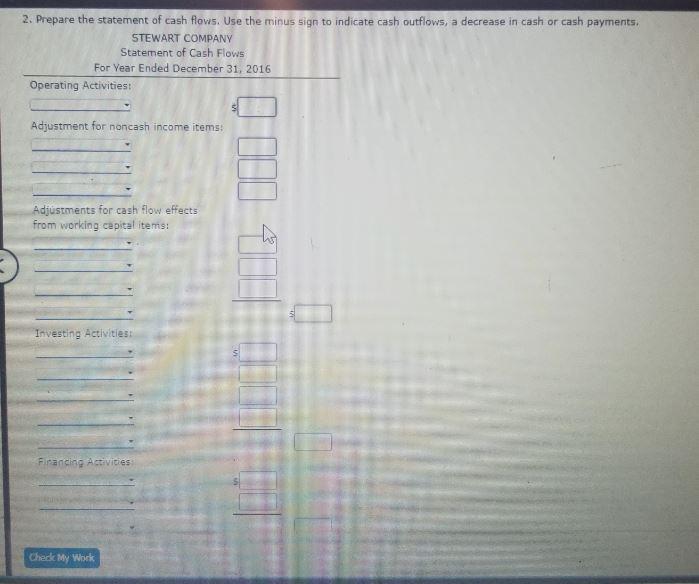

1. Comprehensive: Balance Sheet from Statement of Cash Flows Mills Company prepared the following balance sheet at the beginning of 2016 : Statement of Cash Flows For Year Ended December 31, 2016 Operating Activities: Net income $5,400 Adjustm ents for differences between income flows and cash flows from operating activities: Fin ancing Activities Additional inform ation related to the statement of cash flows: 1. The long-term bonds have a face value of $6,000 and were issued on December 31 , 2016. 2. The building was purchased on December 30, 2016. 3. The land was sold at its original cost. 4. The com mon stock which was sold totaled 300 shares and had a par value of $10 per share. Required: Prepare a classified balance sheet for the Mills Com pany as of December 31,2016 . (Hint: Review the inform ation on the statement of cash flows and the balances in the beginning balance sheet accounts to determine the im pact on the ending balance sheet accounts.) MriLs COMPANY Balsnce Sheet December 31, 2016 Assels Current Assets: Total current assets Property, Plant, and Equipment: Tofal pruperty, plant, and eqpupmient Tal Asset: Liabitities Current Liabilities: Long-Termi Liatilities: Tutal current assets Property, Mant, and Equipments Total property, plant, and equipment. Total Assets Liabilities Current Liabilities: Total current liabilities 5 Long-Term Liabilities: Total iong-term liabilities Total Labllities Shareholders' Equity Contributed Capital: 1. Prepare a spreadsheet to support a 2016 statement of cash flows for Stewert. If an amount is zere, snter "0", STEWART COMPANY Cash Flow From Operating Activities Net income Add: Decrease in accounts receivable Add: Loss on sale of equipment Add: Depreciation expense Add: Increase in accounts payable Less: Increase in inventory Less: Gain on sale of land Cash Flows From Investing Activities Proceeds from sale of land Payment for purchase of land Proceeds from sale of eoulptent Payment for purthase of equlpment Cash flows From Financing Activities Froceefs from is suance of conmon stock Payment of dividends Net increese in cash Tots 5 STENART COMPAVY Statement of C ssh. Flova Forlear Encec Decentoen 31 , 201e Qoiteting =0.0isis 2. Prepare the statement of cash flows. Use the minus sign to indicate cash outflows, a decrease in cash or cash payments. STEWART COMPANY 1. Comprehensive: Balance Sheet from Statement of Cash Flows Mills Company prepared the following balance sheet at the beginning of 2016 : Statement of Cash Flows For Year Ended December 31, 2016 Operating Activities: Net income $5,400 Adjustm ents for differences between income flows and cash flows from operating activities: Fin ancing Activities Additional inform ation related to the statement of cash flows: 1. The long-term bonds have a face value of $6,000 and were issued on December 31 , 2016. 2. The building was purchased on December 30, 2016. 3. The land was sold at its original cost. 4. The com mon stock which was sold totaled 300 shares and had a par value of $10 per share. Required: Prepare a classified balance sheet for the Mills Com pany as of December 31,2016 . (Hint: Review the inform ation on the statement of cash flows and the balances in the beginning balance sheet accounts to determine the im pact on the ending balance sheet accounts.) MriLs COMPANY Balsnce Sheet December 31, 2016 Assels Current Assets: Total current assets Property, Plant, and Equipment: Tofal pruperty, plant, and eqpupmient Tal Asset: Liabitities Current Liabilities: Long-Termi Liatilities: Tutal current assets Property, Mant, and Equipments Total property, plant, and equipment. Total Assets Liabilities Current Liabilities: Total current liabilities 5 Long-Term Liabilities: Total iong-term liabilities Total Labllities Shareholders' Equity Contributed Capital: 1. Prepare a spreadsheet to support a 2016 statement of cash flows for Stewert. If an amount is zere, snter "0", STEWART COMPANY Cash Flow From Operating Activities Net income Add: Decrease in accounts receivable Add: Loss on sale of equipment Add: Depreciation expense Add: Increase in accounts payable Less: Increase in inventory Less: Gain on sale of land Cash Flows From Investing Activities Proceeds from sale of land Payment for purchase of land Proceeds from sale of eoulptent Payment for purthase of equlpment Cash flows From Financing Activities Froceefs from is suance of conmon stock Payment of dividends Net increese in cash Tots 5 STENART COMPAVY Statement of C ssh. Flova Forlear Encec Decentoen 31 , 201e Qoiteting =0.0isis 2. Prepare the statement of cash flows. Use the minus sign to indicate cash outflows, a decrease in cash or cash payments. STEWART COMPANY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts