Question: please show way Opportunity Required Return 12% 15% A B Cash Flows 7500 at the end of the year 5 Year CF 1 10000 2

please show way

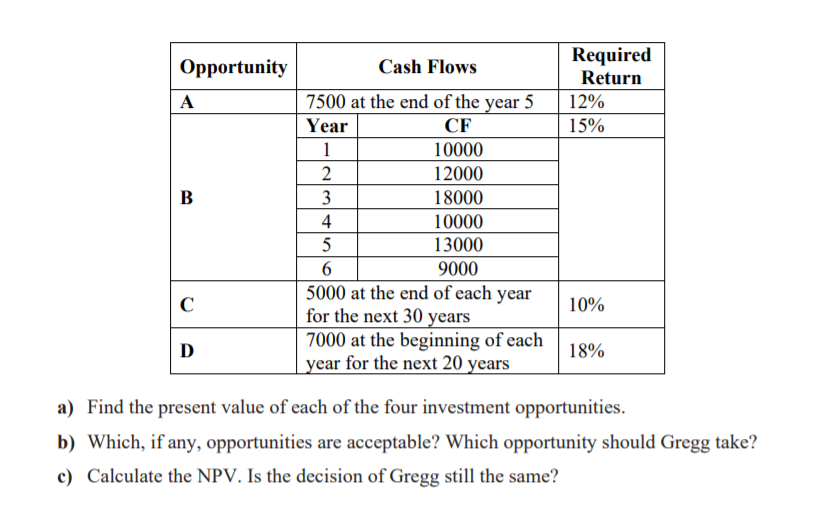

Opportunity Required Return 12% 15% A B Cash Flows 7500 at the end of the year 5 Year CF 1 10000 2 12000 3 18000 4 10000 5 13000 6 9000 5000 at the end of each year for the next 30 years 7000 at the beginning of each year for the next 20 years 10% D 18% a) Find the present value of each of the four investment opportunities. b) Which, if any, opportunities are acceptable? Which opportunity should Gregg take? c) Calculate the NPV. Is the decision of Gregg still the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts