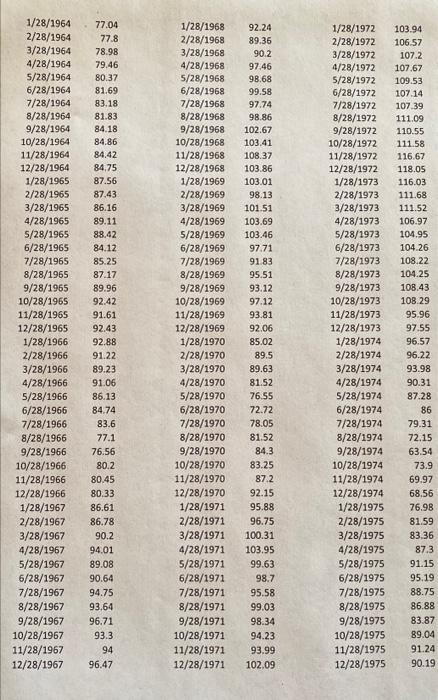

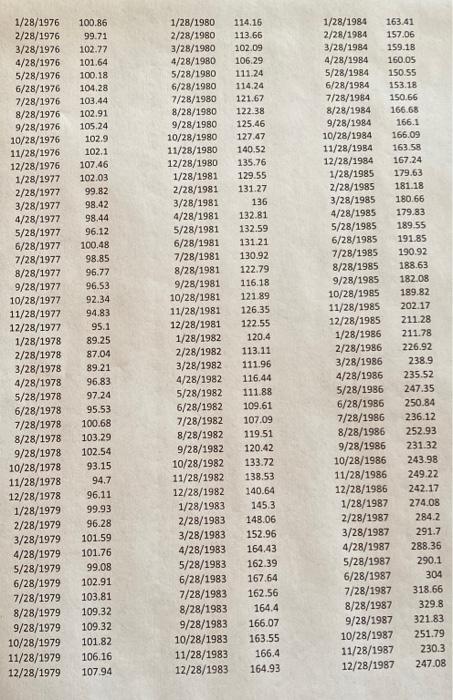

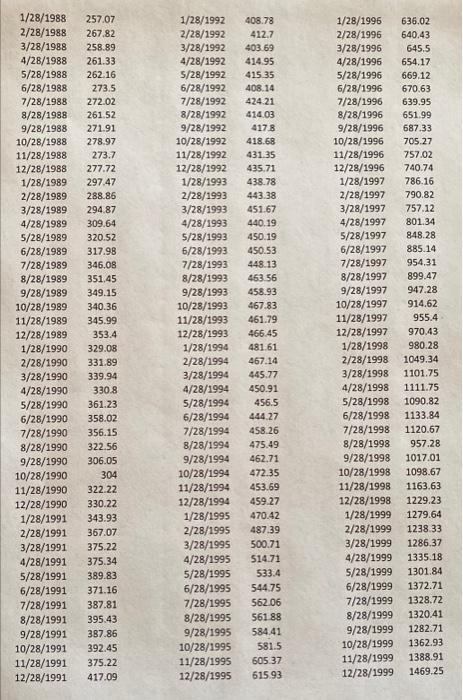

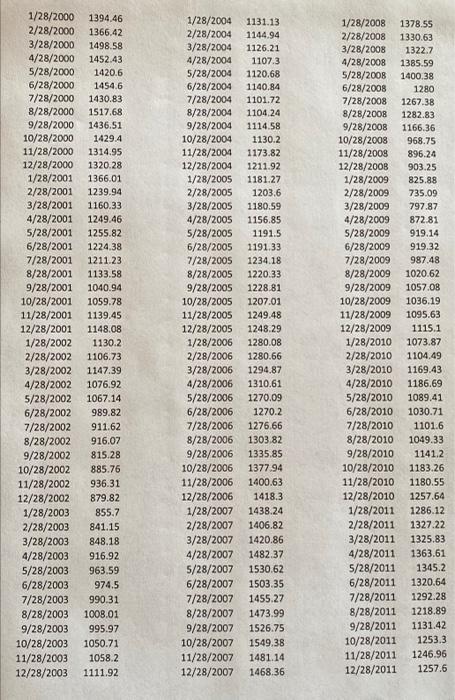

Question: please show with excel formulas. Q7. ( 6 pts) Export the monthly returns on the S&P 500 index from coding challenge 4 to a CSV

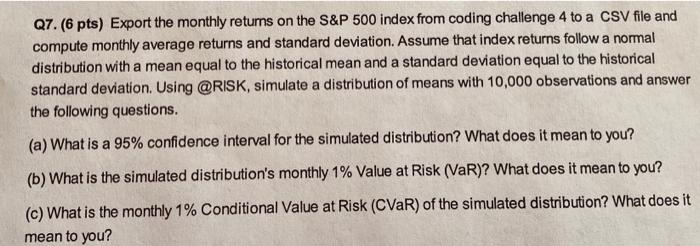

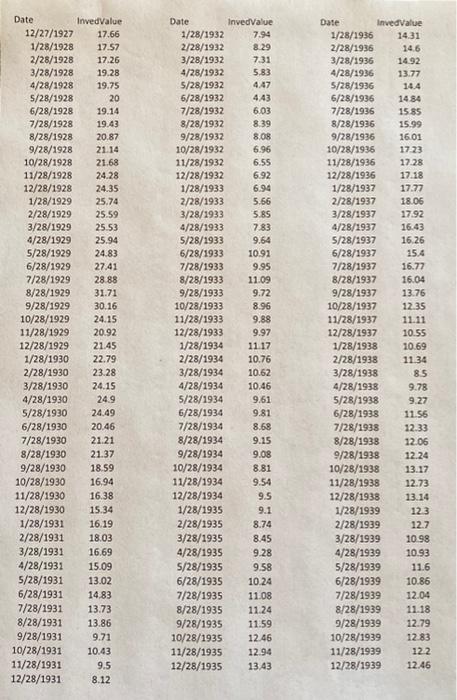

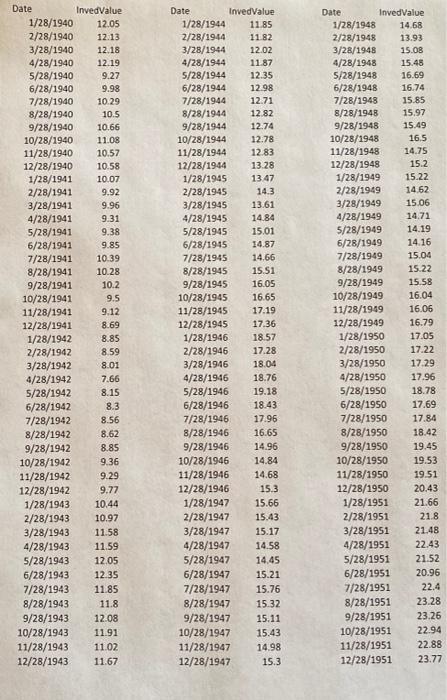

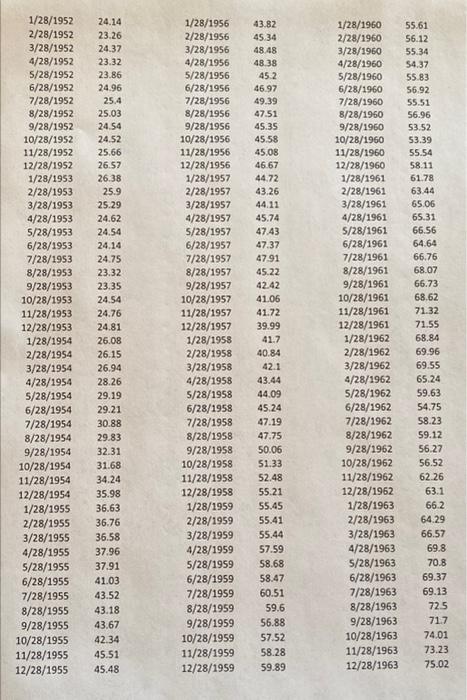

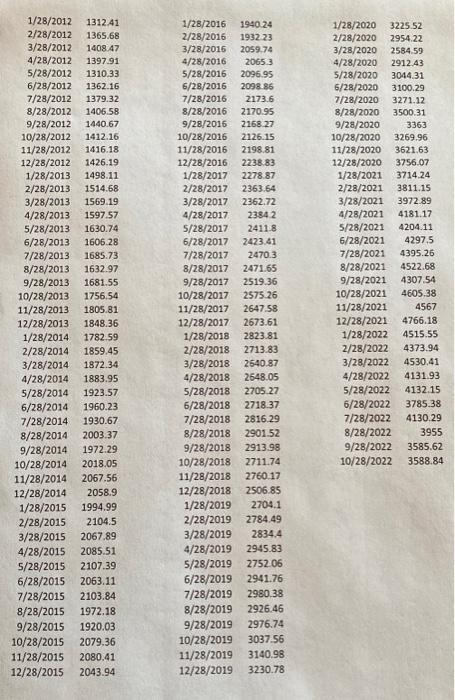

Q7. ( 6 pts) Export the monthly returns on the S\&P 500 index from coding challenge 4 to a CSV file and compute monthly average returns and standard deviation. Assume that index returns follow a normal distribution with a mean equal to the historical mean and a standard deviation equal to the historical standard deviation. Using @RISK, simulate a distribution of means with 10,000 observations and answer the following questions. (a) What is a 95% confidence interval for the simulated distribution? What does it mean to you? (b) What is the simulated distribution's monthly 1% Value at Risk (VaR)? What does it mean to you? (c) What is the monthly 1% Conditional Value at Risk (CVaR) of the simulated distribution? What does it Q7. ( 6 pts) Export the monthly returns on the S\&P 500 index from coding challenge 4 to a CSV file and compute monthly average returns and standard deviation. Assume that index returns follow a normal distribution with a mean equal to the historical mean and a standard deviation equal to the historical standard deviation. Using @RISK, simulate a distribution of means with 10,000 observations and answer the following questions. (a) What is a 95% confidence interval for the simulated distribution? What does it mean to you? (b) What is the simulated distribution's monthly 1% Value at Risk (VaR)? What does it mean to you? (c) What is the monthly 1% Conditional Value at Risk (CVaR) of the simulated distribution? What does it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts