Question: please show work! 1. Expected value (LO6-6 G ) Gary's Pipe and Steel Company expects sales next year to be $800,000 if the economy is

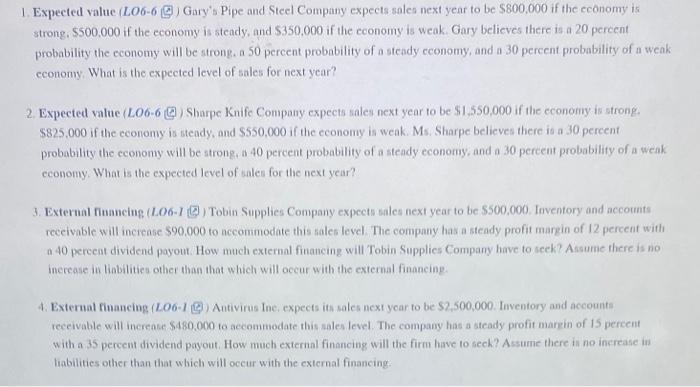

1. Expected value (LO6-6 G ) Gary's Pipe and Steel Company expects sales next year to be $800,000 if the economy is strong, $500,000 if the economy is steady, and $350,000 if the economy is weak. Gary believes there is a 20 perecnt probability the economy will be strong, a 50 percent probability of a steady cconomy, and a 30 percent probability of a weak economy. What is the expected level of sales for next year? 2. Expected value (LO6-6 GG) Sharpe Knife Company expects sales next year to be $1.550,000 if the economy is strong. $825,000 if the economy is steady, and $550,000 if the economy is weak. Ms. Sharpe believes there is a 30 percent probability the cconomy will be strong, a 40 percent probability of a steady economy, and a 30 percent probability of a weak economy. What is the expected level of sales for the next year? 3. External finneine, (LO6-I () ) Tobin. Supplies Company expects sales next year to be $500,000. Inventory and accounts receivable will increase $90,000 to accommodate this sales level. The company has a steady profit margin of 12 pereent with a 40 pereent dividend payout. How much external finaneing will Tobin Supplies Company have to seek? A sume there is no inerease in linbilities other than that which will occur with the external financing 4. Exterual financing (LO6-1 () Antivirus Ine, expects ith sales next year to be $2,500,000. Inventory and account: receivable will increase $480,000 to accommodate this sales level. The company has a steady profit margin of 15 pereent with a 35 pereent dividend payout. How much exiernal financing will the firm have to sech? Assume there in no increase in liabilities other than that which will occur with the external financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts