Question: Please show work! 1. Using the corporate valuation model, the value of a company's operations is $550 million. The company's balance sheet includes $75 million

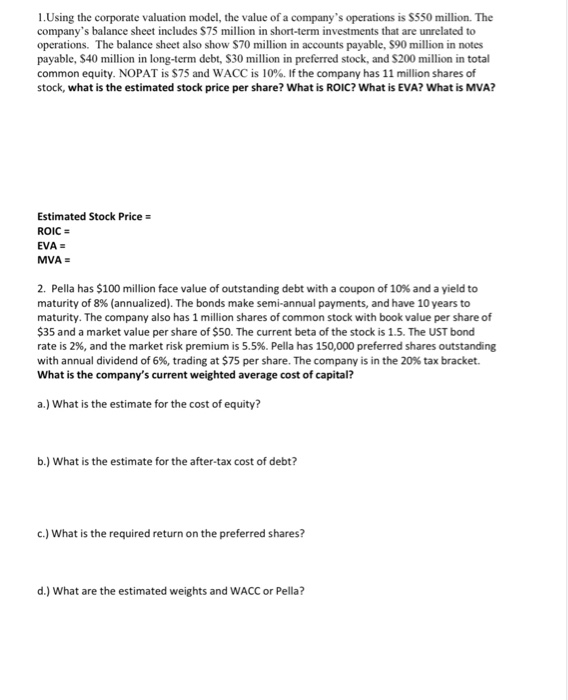

1. Using the corporate valuation model, the value of a company's operations is $550 million. The company's balance sheet includes $75 million in short-term investments that are unrelated to operations. The balance sheet also show $70 million in accounts payable, S90 million in notes payable, S40 million in long-term debt, $30 million in preferred stock, and S200 million in total common equity. NOPAT is $75 and WACC is 10%. If the company has 11 million shares of stock, what is the estimated stock price per share? What is ROIC? What is EVA? What is MVA? Estimated Stock Price = ROIC = EVA = MVA = 2. Pella has $100 million face value of outstanding debt with a coupon of 10% and a yield to maturity of 8% (annualized). The bonds make semi-annual payments, and have 10 years to maturity. The company also has 1 million shares of common stock with book value per share of $35 and a market value per share of $50. The current beta of the stock is 1.5. The UST bond rate is 2%, and the market risk premium is 5.5%. Pella has 150,000 preferred shares outstanding with annual dividend of 6%, trading at $75 per share. The company is in the 20% tax bracket. What is the company's current weighted average cost of capital? a.) What is the estimate for the cost of equity? b.) What is the estimate for the after-tax cost of debt? c.) What is the required return on the preferred shares? d.) What are the estimated weights and WACC or Pella? MACRS table required 0.3333, 0.4445, 0.1481, 0.0741, respectively) 3. JB Hunt is evaluating a potential lease agreement on a truck that costs $80,000 and falls into the MACRS 3-year class. The loan rate would be 9 percent & would be interest only over the 4-year period, with the principal due at the end, if the firm decided to borrow money & buy the asset rather than lease it. The loan payments would be made at the end of the year. The truck has a 4- year economic life, and its estimated salvage value is $15,000. If the firm buys the truck, it would purchase a maintenance contract that costs $3,000 per year, payable at the end of each year. The lease terms, which include maintenance, call for a $20,000 lease payment at the beginning of each year. The tax rate is 40 percent. Should the firm lease or borrow? Calculate the NAL. Net advantage to leasing (NAL) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts