Question: Please show work 11. Three years ago you bought a home with a purchase price of $220,000 and you are paid 10% of that amount

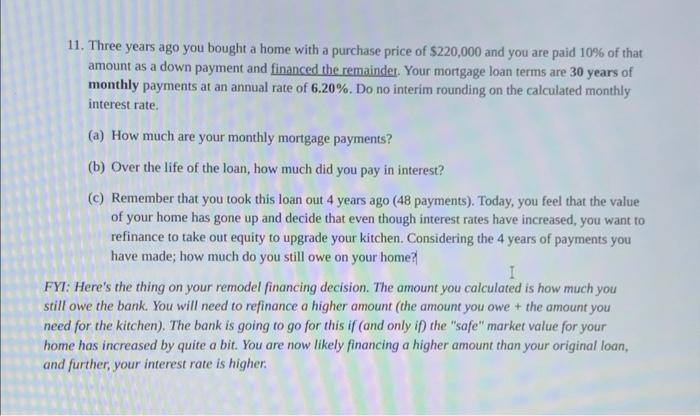

11. Three years ago you bought a home with a purchase price of $220,000 and you are paid 10% of that amount as a down payment and financed the remainder. Your mortgage loan terms are 30 years of monthly payments at an annual rate of 6.20%. Do no interim rounding on the calculated monthly interest rate. (a) How much are your monthly mortgage payments? (b) Over the life of the loan, how much did you pay in interest? (c) Remember that you took this loan out 4 years ago (48 payments). Today, you feel that the value of your home has gone up and decide that even though interest rates have increased, you want to refinance to take out equity to upgrade your kitchen. Considering the 4 years of payments you have made; how much do you still owe on your home? FII: Here's the thing on your remodel financing decision. The amount you calculated is how much you till owe the bank. You will need to refinance a higher amount (the amount you owe t the amount you leed for the kitchen). The bank is going to go for this if (and only if) the "safe" market value for your ome has increased by quite a bit. You are now likely financing a higher amount than your original loan, and further, your interest rate is higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts