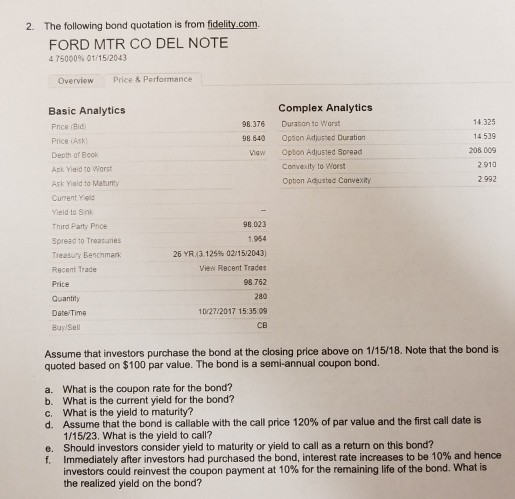

Question: Please show work 2. The following bond quotation is from fidelity.com. FORD MTR CO DEL NOTE 4 75000% 01/15/2043 Overview Price & Performance Complex Analytics

Please show work

2. The following bond quotation is from fidelity.com. FORD MTR CO DEL NOTE 4 75000% 01/15/2043 Overview Price & Performance Complex Analytics Basic Analytics Prics (Bid Price iAsk Depth of Book Ask Yield to worst Ask Yield to Maburity Current Yld Yield to Snk Third Party Price Spread to Treasuries Treasury Benchmark Recent Trade Price Quantity Date Time Buy Sell 14.325 14 539 208.009 2910 2 992 98.376 Duraton to Worst 98 640Opion Adjuzted Duration Opton Adjusied Spread Convesity to Worst Option Adusted Convexity igw 98.023 1.954 26 YR13. 129% 02/15/2043) View Recent Trades 98.762 280 10/27/2017 15:35:09 CB Assume that investors purchase the bond at the closing price above on 1/15/18. Note that the bond is quoted based on $100 par value. The bond is a semi-annual coupon bono. What is the coupon rate for the bond? What is the current yield for the bond? What is the yield to maturity? Assume that the bond is callable with the call price 120% of par value and the first call date is 1/15/23. What is the yield to call? Should investors consider yield to maturity or yield to call as a return on this bond? Immediately after investors had purchased the bond, interest rate increases to be 10% and hence investors could reinvest the coupon payment at 10% for the remaining life of the bond, what is the realized yield on the bond? a. b. c. d. e. f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts