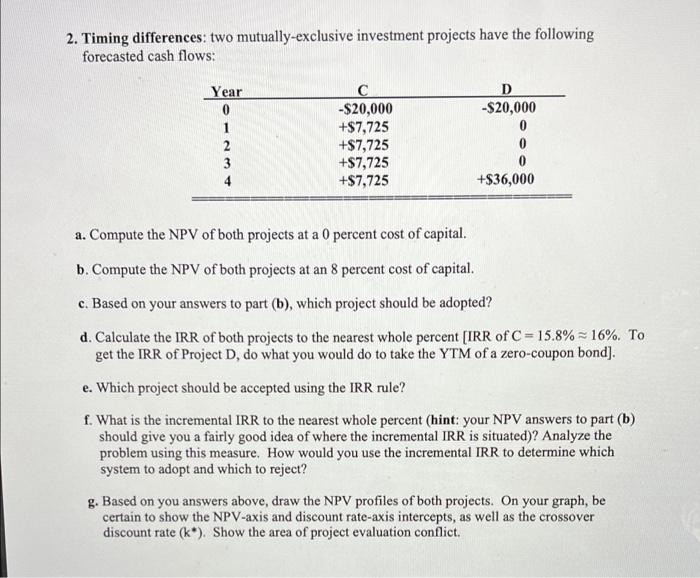

Question: please show work 2. Timing differences: two mutually-exclusive investment projects have the following forecasted cash flows: Year 0 1 2 3 -$20,000 +$7,725 +$7,725 +$7,725

2. Timing differences: two mutually-exclusive investment projects have the following forecasted cash flows: Year 0 1 2 3 -$20,000 +$7,725 +$7,725 +$7,725 +$7,725 D -$20,000 0 0 +$36,000 a. Compute the NPV of both projects at a 0 percent cost of capital. b. Compute the NPV of both projects at an 8 percent cost of capital. c. Based on your answers to part (b), which project should be adopted? d. Calculate the IRR of both projects to the nearest whole percent (IRR of C = 15.8%-16%. To get the IRR of Project D, do what you would do to take the YTM of a zero-coupon bond). e. Which project should be accepted using the IRR rule? f. What is the incremental IRR to the nearest whole percent (hint: your NPV answers to part (b) should give you a fairly good idea of where the incremental IRR is situated)? Analyze the problem using this measure. How would you use the incremental IRR to determine which system to adopt and which to reject? g. Based on you answers above, draw the NPV profiles of both projects. On your graph, be certain to show the NPV-axis and discount rate-axis intercepts, as well as the crossover discount rate (k*). Show the area of project evaluation conflict

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts