Question: PLEASE SHOW WORK A five-year $100,000 bond with a 6% stated interest rate and a 9% yield rate is purchased on 12/31/09 for $88,331. The

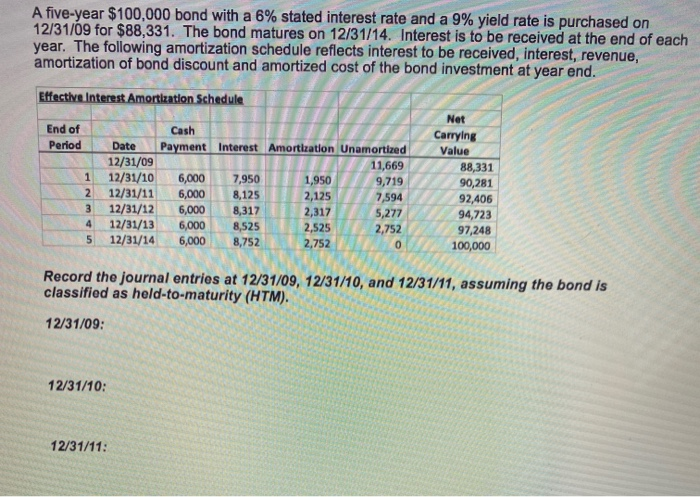

A five-year $100,000 bond with a 6% stated interest rate and a 9% yield rate is purchased on 12/31/09 for $88,331. The bond matures on 12/31/14. Interest is to be received at the end of each year. The following amortization schedule reflects interest to be received, interest, revenue amortization of bond discount and amortized cost of the bond investment at year end. Effective Interest Amortization Schedule End of Period Cash Date Payment Interest Amortization Unamortized 12/31/09 11,669 12/31/10 6,000 7,950 1,950 9,719 12/31/11 6,000 8,125 2,125 7,594 12/31/12 6,000 8.317 5,277 12/31/13 6,000 8,525 2,752 12/31/146,000 8,7522 ,752 Net Carrying Value 88,331 90,281 92,406 94,723 97,248 100,000 3 2,317 2,525 5 Record the journal entries at 12/31/09, 12/31/10, and 12/31/11, assuming the bond is classified as held-to-maturity (HTM). 12/31/09: 12/31/10: 12/31/11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts