Question: Please show work and answer all 4 questions. You and your spouse have each turned 60 and you are thinking of retiring. You have also

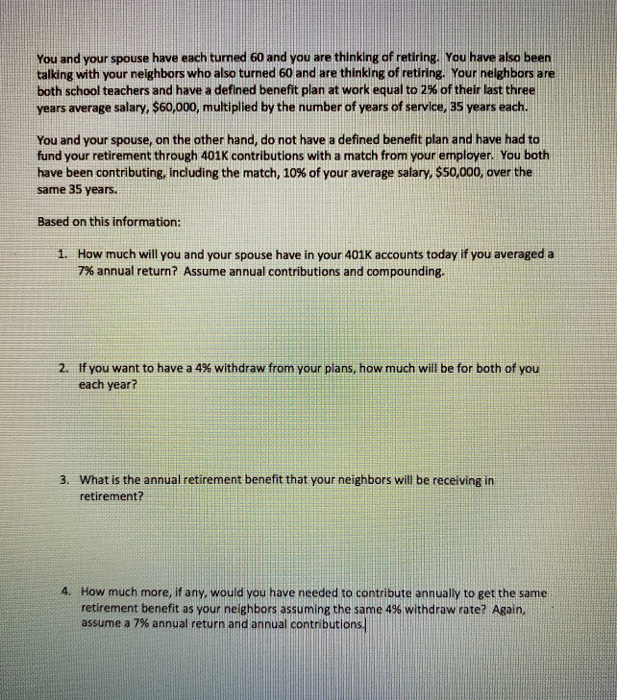

You and your spouse have each turned 60 and you are thinking of retiring. You have also been talking with your neighbors who also turned 60 and are thinking of retiring. Your neighbors are both school teachers and have a defined benefit plan at work equal to 2% of their last three years average salary, $60,000, multiplied by the number of years of service, 35 years each. You and your spouse, on the other hand, do not have a defined benefit plan and have had to fund your retirement through 401K contributions with a match from your employer. You both have been contributing, including the match, 10% of your average salary, $50,000, over the same 35 years. Based on this information: 1. How much will you and your spouse have in your 401K accounts today if you averaged a 7% annual return? Assume annual contributions and compounding. 2. If you want to have a 4% withdraw from your plans, how much will be for both of you each year? 3. What is the annual retirement benefit that your neighbors will be receiving in retirement? 4. How much more, if any, would you have needed to contribute annually to get the same retirement benefit as your neighbors assuming the same 4% withdraw rate? Again assume a 7% annual return and annual contributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts