Question: please show work and bried explanations Question 4 You are planning to invest into two assets. One asset is the ETF fund that tracks returns

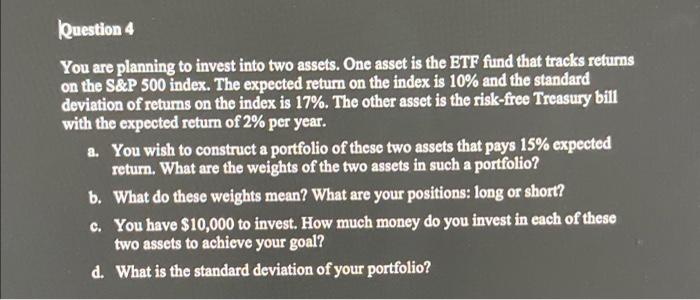

Question 4 You are planning to invest into two assets. One asset is the ETF fund that tracks returns on the S&P 500 index. The expected return on the index is 10% and the standard deviation of returns on the index is 17%. The other asset is the risk-free Treasury bill with the expected return of 2% per year. a. You wish to construct a portfolio of these two assets that pays 15% expected return. What are the weights of the two assets in such a portfolio? b. What do these weights mean? What are your positions: long or short? c. You have $10,000 to invest. How much money do you invest in each of these two assets to achieve your goal? d. What is the standard deviation of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts