Question: Please show work and choose A, B, C, or D. The 12-month interest rate on dollar-denominated assets (like bank deposits) is 2.00%. The 12- month

Please show work and choose A, B, C, or D.

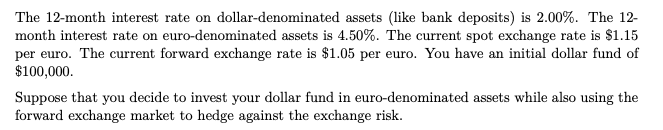

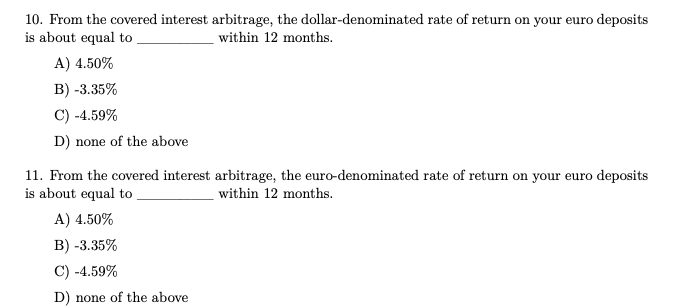

The 12-month interest rate on dollar-denominated assets (like bank deposits) is 2.00%. The 12- month interest rate on euro-denominated assets is 4.50%. The current spot exchange rate is $1.15 per euro. The current forward exchange rate is $1.05 per euro. You have an initial dollar fund of $100,000. Suppose that you decide to invest your dollar fund in euro-denominated assets while also using the forward exchange market to hedge against the exchange risk. 10. From the covered interest arbitrage, the dollar-denominated rate of return on your euro deposits is about equal to within 12 months. A) 4.50% B)-3.35% C)-4.59% D) none of the above 11. From the covered interest arbitrage, the euro-denominated rate of return on your euro deposits is about equal to within 12 months. A) 4.50% B)-3.35% C)-4.59% D) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts