Question: please show work and explain. For 2019, Perla, who is single and 55 years of age, had AGI of $60,000. During the year, she incurred

please show work and explain.

please show work and explain.

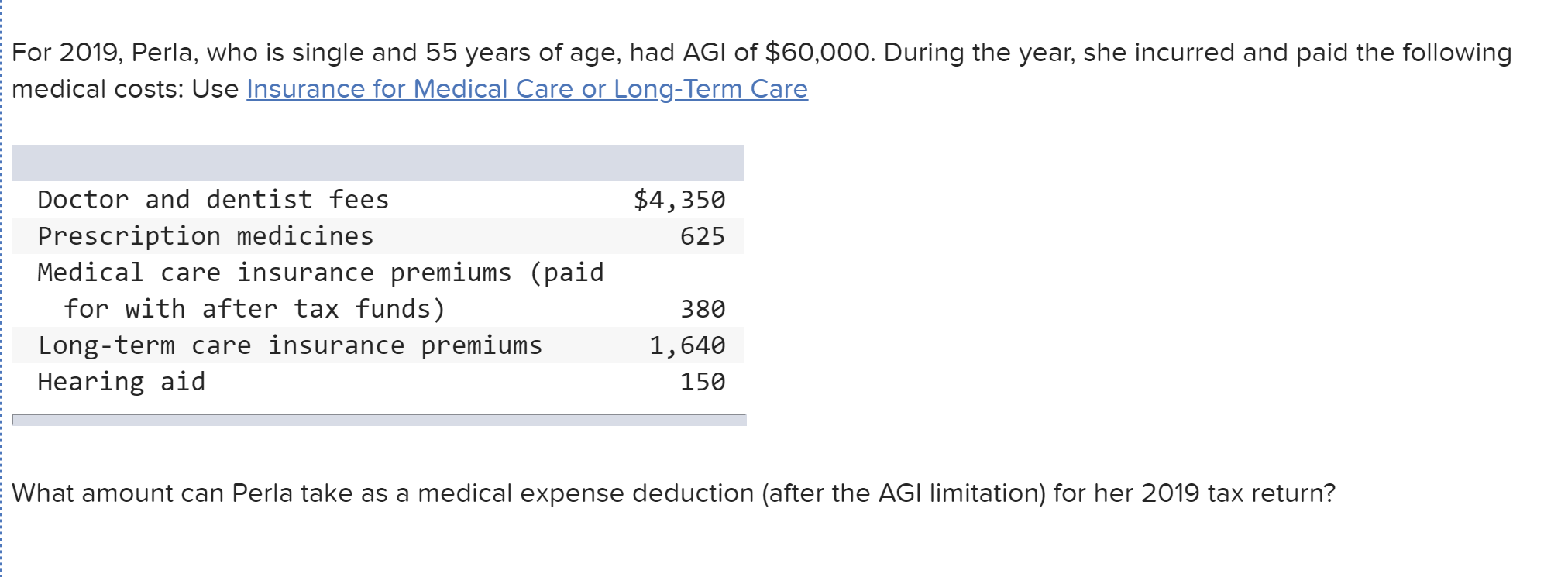

For 2019, Perla, who is single and 55 years of age, had AGI of $60,000. During the year, she incurred and paid the following medical costs: Use Insurance for Medical Care or Long-Term Care $4,350 625 Doctor and dentist fees Prescription medicines Medical care insurance premiums (paid for with after tax funds) Long-term care insurance premiums Hearing aid 380 1,640 150 What amount can Perla take as a medical expense deduction (after the AGI limitation) for her 2019 tax return? Multiple Choice $7,145. $2,645. o $2,585. $531

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock