Question: Please show work and explain. (Highlighted answers are correct) 22. Stetson Company's financial information is presented below Purchase Returns and Allowances S 30.000 Ending Merchandise

Please show work and explain.

(Highlighted answers are correct)

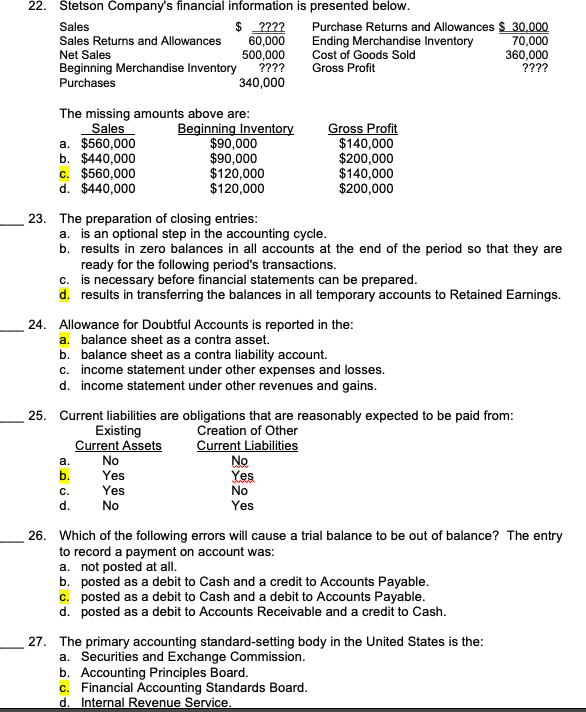

22. Stetson Company's financial information is presented below Purchase Returns and Allowances S 30.000 Ending Merchandise Inventory Cost of Goods Sold Gross Profit $ 60,000 500,000 ???? Sales ???? 70,000 360,000 ???? Sales Returns and Allowances Net Sales Beginning Merchandise Inventory Purchases 340,000 The missing amounts above are: Sales Beginning Inventory $90,000 $90,000 $120,000 $120,000 Gross Profit $140,000 $200,000 $140,000 $200,000 $560,000 b. $440,000 c. $560,000 d. $440,000 . 23. The preparation of closing entries: is an optional step in the accounting cycle. b. results in zero balances in all accounts at the end of the period so that they are ready for the following period's transactions. is necessary before financial statements can be prepared d. results in transferring the balances in all temporary accounts to Retained Earnings. . C. Allowance for Doubtful Accounts is reported in the: a. balance sheet as a contra asset. b. balance sheet as a contra liability account income statement under other expenses and losses. d. income statement under other revenues and gains. 24 C. 25. Current liabilities are obligations that are reasonably expected to be paid from: Existing Current Assets No Yes Yes No Creation of Other Current Liabilities No Yes No Yes a. b. c. d. 26. Which of the following errors will cause a trial balance to be out of balance? The entry to record a payment not posted at all. b. posted as a debit to Cash and a credit to Accounts Payable c. posted as a debit to Cash and a debit to Accounts Payable. d. posted as a debit to Accounts Receivable and a credit to Cash on account was: a. 27. The primary accounting standard-setting body in the United States is the: a. Securities and Exchange Commission b. Accounting Principles Board. c. Financial Accounting Standards Board d. Internal Revenue Service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts