Question: Please show work and help solve this finance problem This problem considers the risk and return on your investment if you purchase a house today

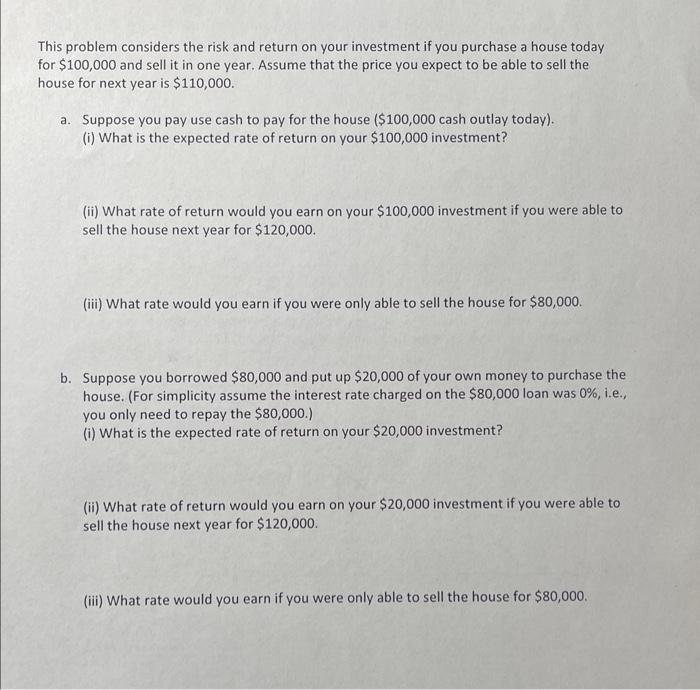

This problem considers the risk and return on your investment if you purchase a house today for $100,000 and sell it in one year. Assume that the price you expect to be able to sell the house for next year is $110,000. a. Suppose you pay use cash to pay for the house ( $100,000 cash outlay today). (i) What is the expected rate of return on your $100,000 investment? (ii) What rate of return would you earn on your $100,000 investment if you were able to sell the house next year for $120,000. (iii) What rate would you earn if you were only able to sell the house for $80,000. b. Suppose you borrowed $80,000 and put up $20,000 of your own money to purchase the house. (For simplicity assume the interest rate charged on the $80,000 loan was 0%, i.e., you only need to repay the $80,000.) (i) What is the expected rate of return on your $20,000 investment? (ii) What rate of return would you earn on your $20,000 investment if you were able to sell the house next year for $120,000. (iii) What rate would you earn if you were only able to sell the house for $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts