Question: Please show work and let me know if a, b, c or d is correct. Thanks. if interest rate is expected to fall (rise) the

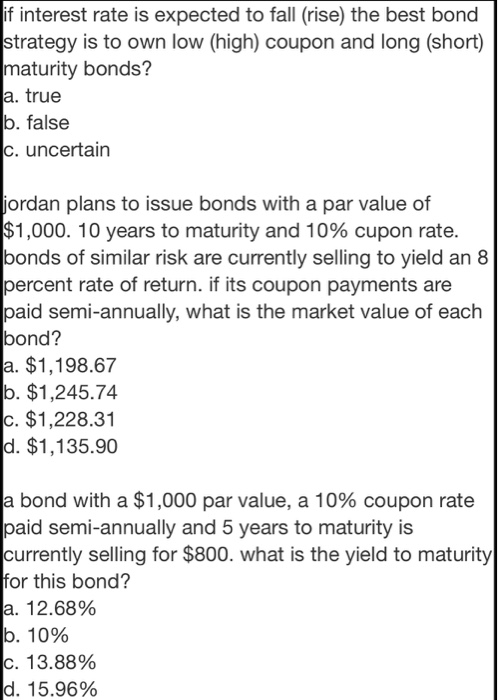

if interest rate is expected to fall (rise) the best bond strategy is to own low (high) coupon and long (short) maturity bonds? a. true b. false c. uncertain jordan plans to issue bonds with a par value of $1,000. 10 years to maturity and 10% cupon rate. bonds of similar risk are currently selling to yield an 8 percent rate of return. if its coupon payments are paid semi-annually, what is the market value of each bond? a. $1,198.67 b. $1,245.74 c. $1,228.31 d. $1,135.90 a bond with a $1,000 par value, a 10% coupon rate paid semi-annually and 5 years to maturity is currently selling for $800. what is the yield to maturity for this bond? a. 12.68% b. 10% c. 13.88% d. 15.96%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts