Question: please show work and steps. I really appreciate it. 2. Stock prices and intrinsic values A Aa Benjamin Graham, the father of value investing, once

please show work and steps. I really appreciate it.

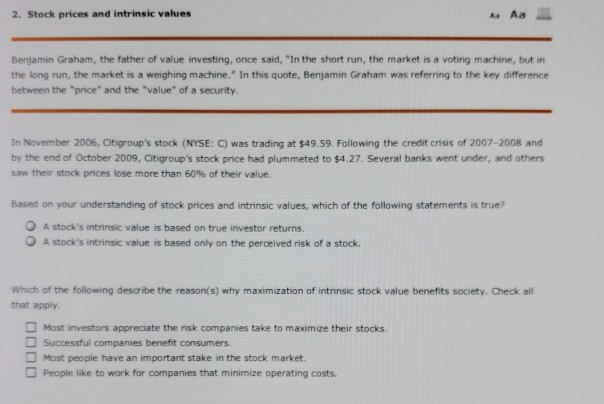

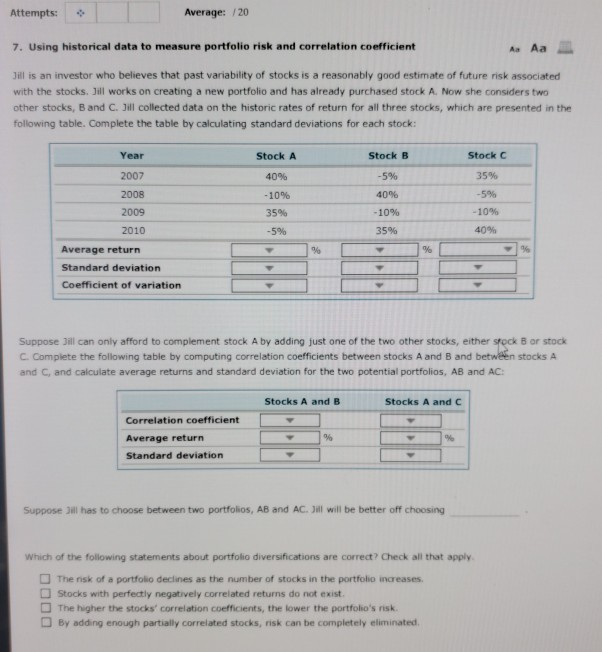

2. Stock prices and intrinsic values A Aa Benjamin Graham, the father of value investing, once said, "In the short run, the market is a voting machine, but in the long run, the market is a weighing machine." In this quote, Benjamin Graham was referring to the key difference between the "price" and the value of a security In November 2006, Citigroup's stock (NYSE: C) was trading at $49.59. Following the credit crisis of 2007-2008 and by the end of October 2009, Citigroup's stock price had plummeted to $4.27. Several banks went under, and others saw their stock prices lose more than 60% of their value. Based on your understanding of stock prices and intrinsic values, which of the following statements is true? O O Astock's intrinsic value is based on true investor returns. A stock's intrinsic value is based only on the perceived risk of a stock. Which of the following describe the reason(s) why maximization of intrinsic stock value benefits society. Check all that apply. Most investors appreciate the risk companies take to maximize their stocks Successful companies benefit consumers. Most people have an important stake in the stock market People like to work for companies that minimize operating costs. Attempts: Average: /20 7. Using historical data to measure portfolio risk and correlation coefficient . Jill is an investor who believes that past variability of stocks is a reasonably good estimate of future risk associated with the stocks, Jill works on creating a new portfolio and has already purchased stock A. Now she considers two other stocks, B and C. Jill collected data on the historic rates of return for all three stocks, which are presented in the following table. Complete the table by calculating standard deviations for each stock: Year Stock A Stock B Stock C 40% 35% 2007 2008 2009 -596 -10% 35% -5% -5% 40% -10% 35% -10% 2010 409 Average return Standard deviation Coefficient of variation Suppose Jill can only afford to complement stock A by adding just one of the two other stocks, either stock B or stock C. Complete the following table by computing correlation coefficients between stocks A and B and between stocks A and C, and calculate average returns and standard deviation for the two potential portfolios, AB and AC: Stocks A and B Stocks A and C Correlation coefficient Average return Standard deviation Suppose Jill has to choose between two portfolios, AB and AC, Jill will be better off choosing Which of the following statements about portfolio diversifications are correct? Check all that apply The risk of a portfolio declines as the number of stocks in the portfolio increases Stocks with perfectly negatively correlated returns do not exist The higher the stocks' correlation coefficients, the lower the portfolio's risk By adding enough partially correlated stocks, risk can be completely eliminated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts