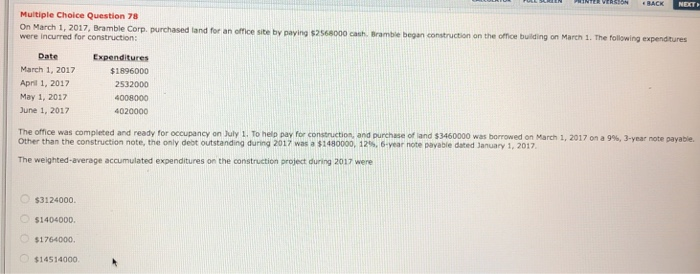

Question: please show work BACK NEXT Multiple Choice Question 78 On March 1, 2017, Bramble Corp, purchased land for an office site by paying $2568000 cash.

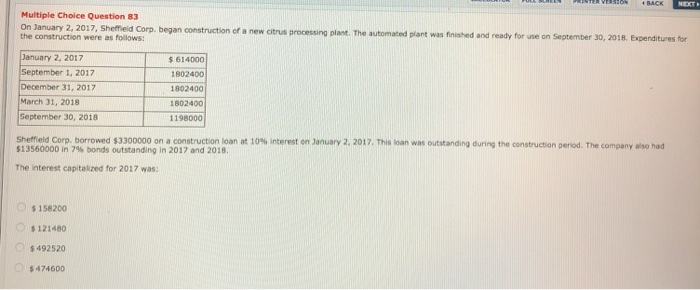

BACK NEXT Multiple Choice Question 78 On March 1, 2017, Bramble Corp, purchased land for an office site by paying $2568000 cash. Bramble began were incurred for construction began construction on the office building on March 1. The following expenditures Date Expenditures $1896000 2532000 4008000 4020000 March 1, 2017 April 1, 2017 May 1, 2017 June 1, 2017 The ornce was completed and ready for occupancy on July i To help pay for construction and purchase of land $346 000 was borrowed on March 1 2017 on a 9% 3-year note payable Other than the construction note, the only debt outstanding during 2017 was a $1480000, 12%, 6-year note Davabie dated January 1, 2017 The weighted-average accumulated expenditures on the construction project during 2017 were $3124000 $1404000. $1764000. $14514000 NXT Multiple Choice Question 83 On January 2, 2017, Sheffieid Corp. began construction of a new citrus processing plast. The automated plant was finished and ready for use on September 30, 2018. Expenditures for the construction were as follows January 2, 2017 September 1, 2017 December 31, 2017 March 31, 2018 September 30, 2018 $ 614000 1802400 1802400 1802400 1198000 Sher eld Co borrowed $33000 on a construction an at 10% interest on January 2, 2017. This loan was outstanding during the construction pe $13560000 in 7% bonds outstanding in 2017 and 2018. d. The company as a The interest capitalized for 2017 was: O $158200 s121480 $492520 474600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts