Question: Please show work Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial

Please show work

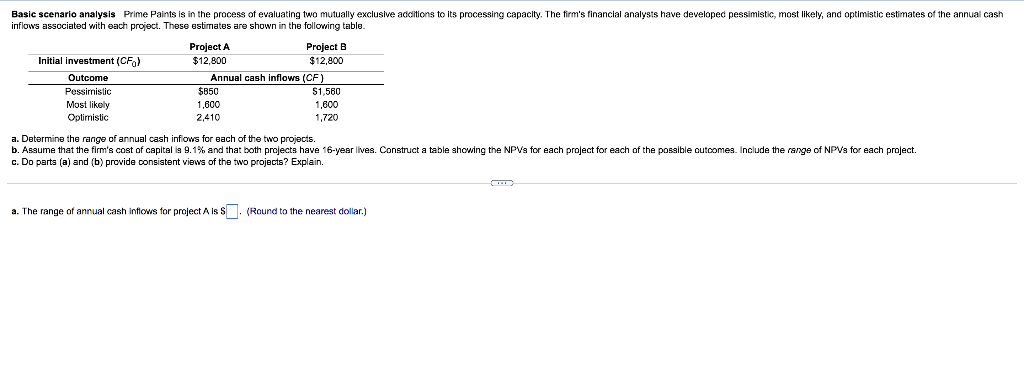

Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. Project A Project B $12,800 Initial investment (CF) $12,800 Outcome Annual cash inflows (CF) Pessimistic $850 $1.580 Most likely 1,600 1,600 1,720 Optimistic 2,410 a. Determine the range of annual cash inflows for each of the two projects. b. Assume that the firm's cost of capital is 9.1% and that both projects have 16-year lives. Construct a table showing the NPVs for each project for each of the possible outcomes. Include the range of NPVs for each project. c. Do parts (a) and (b) provide consistent views of the two projects? Explain. a. The range of annual cash inflows for project A is S. (Round to the nearest dollar.) Basic scenario analysis Prime Paints is in the process of evaluating two mutually exclusive additions to its processing capacity. The firm's financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows associated with each project. These estimates are shown in the following table. Project A Project B $12,800 Initial investment (CF) $12,800 Outcome Annual cash inflows (CF) Pessimistic $850 $1.580 Most likely 1,600 1,600 1,720 Optimistic 2,410 a. Determine the range of annual cash inflows for each of the two projects. b. Assume that the firm's cost of capital is 9.1% and that both projects have 16-year lives. Construct a table showing the NPVs for each project for each of the possible outcomes. Include the range of NPVs for each project. c. Do parts (a) and (b) provide consistent views of the two projects? Explain. a. The range of annual cash inflows for project A is S. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts