Question: Please show work BE SURE TO SHOW YOUR WORK 1. Consider the free cash flow approach to stock valuation. Precision Manufacturing Company is expected to

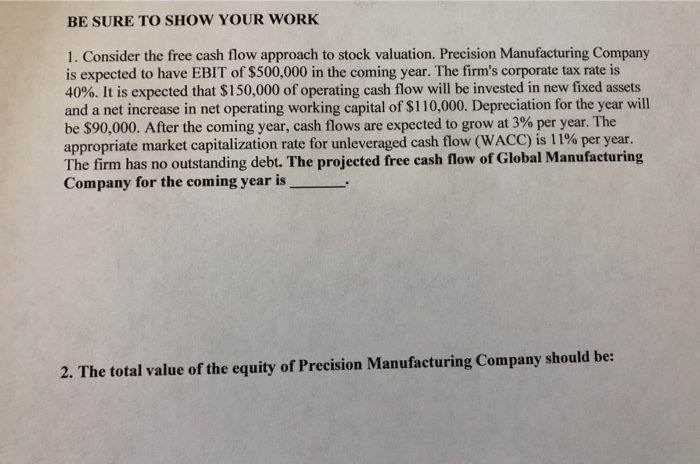

BE SURE TO SHOW YOUR WORK 1. Consider the free cash flow approach to stock valuation. Precision Manufacturing Company is expected to have EBIT of $500,000 in the coming year. The firm's corporate tax rate is 40%. It is expected that $150,000 of operating cash flow will be invested in new fixed assets and a net increase in net operating working capital of $110,000. Depreciation for the year will be $90,000. After the coming year, cash flows are expected to grow at 3% per year. The appropriate market capitalization rate for unleveraged cash flow (WACC) is 11% per year. The firm has no outstanding debt. The projected free cash flow of Global Manufacturing Company for the coming year is 2. The total value of the equity of Precision Manufacturing Company should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts