Question: please show work! Brief Exercise 20-8 Change in estimate; useful life of patent [LO20-4) Van Frank Telecommunications has a patent on a cellular transmission process.

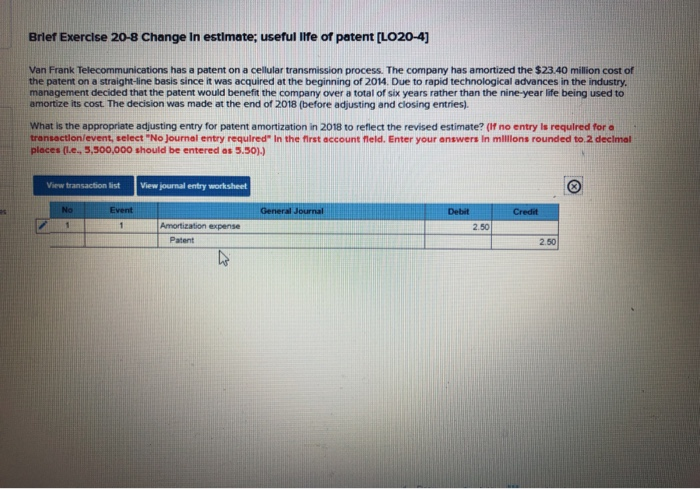

Brief Exercise 20-8 Change in estimate; useful life of patent [LO20-4) Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the $23.40 million cost of the patent on a straight-line basis since it was acquired at the beginning of 2014. Due to rapid technological advances in the industry. management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2018 (before adjusting and closing entries) What is the appropriate adjusting entry for patent amortization in 2018 to reflect the revised estimate? (If no entry is required for a transaction/event, select "No Journal entry required in the first account fleld. Enter your answers in millions rounded to 2 decimal places (.e., 5,500,000 should be entered as 5.50).) View transaction list View journal entry worksheet No he Event 11 General Journal Debit Credit 2.50 Amortization expense Patent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts