Question: PLEASE SHOW WORK, BUT SOLVE THE PROBLEM WITHOUT USING EXCEL. 1) Consider a bond with a face value of $10,000, a coupon rate of 8.00%

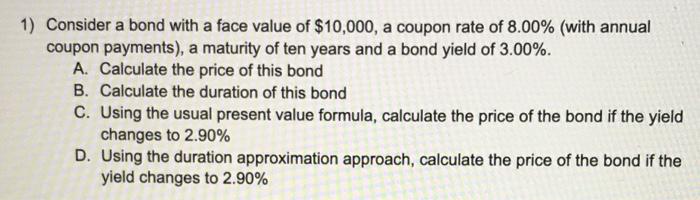

1) Consider a bond with a face value of $10,000, a coupon rate of 8.00% (with annual coupon payments), a maturity of ten years and a bond yield of 3.00%. A. Calculate the price of this bond B. Calculate the duration of this bond C. Using the usual present value formula, calculate the price of the bond if the yield changes to 2.90% D. Using the duration approximation approach, calculate the price of the bond if the yield changes to 2.90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts