Question: please show work by hand and not through excel. I need to see the steps. thank you! 20. Assume that you are considering the purchase

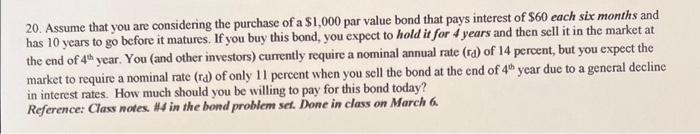

20. Assume that you are considering the purchase of a $1,000 par value bond that pays interest of $60 each six months and has 10 years to go before it matures. If you buy this bond, you expect to hold it for 4 years and then sell it in the market at the end of 4th year. You (and other investors) currently require a nominal annual rate ( rdd) of 14 percent, but you expect the market to require a nominal rate (rd) of only 11 percent when you sell the bond at the end of 4th year due to a general decline in interest rates. How much should you be willing to pay for this bond today? Reference: Class notes. Hs in the bond problem set. Done in class on March 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts