Question: PLEASE SHOW WORK ( CELL REFERENCE INCLUDED IF POSSIBLE ) Dropping Or Retaining A Segment JayCo Ltd. currently manufactures three different tennis racquets: The Power,

PLEASE SHOW WORK ( CELL REFERENCE INCLUDED IF POSSIBLE )

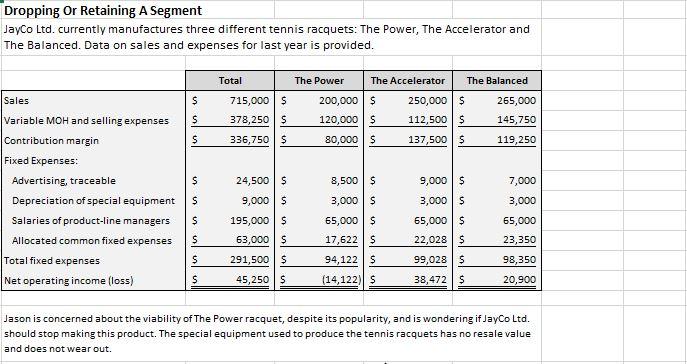

Dropping Or Retaining A Segment JayCo Ltd. currently manufactures three different tennis racquets: The Power, The Accelerator and The Balanced. Data on sales and expenses for last year is provided. Total Sales $ The Power The Accelerator The Balanced 200,000 $ 250,000 $ 265,000 120,000 $ 112,500 $ 145,750 80,000 $ 137,500 $ 119,250 715,000 $ 378,250 $ 336,750 $ $ $ $ 8,500 $ Variable MOH and selling expenses Contribution margin Fixed Expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses Total fixed expenses Net operating income (loss) 7,000 3,000 $ $ 24,500 5 9,000 $ 195,000 $ 63,000 $ 291,500 $ 45,250 $ 3,000 $ 65,000 $ 17,622 s 65,000 9,000 $ 3,000 S 65,000 $ 22,028 99,028 $ 38,4725 $ 23,350 $ 94,122 $ 98,350 $ (14,122) S 20,900 Jason is concerned about the viability of The Power racquet, despite its popularity, and is wondering if JayCo Ltd. should stop making this product. The special equipment used to produce the tennis racquets has no resale value and does not wear out Should production and sale of The Power be discontinued? Show calculations and Explain. Differential Analysis approach You can use either of these templates for your calculations. You do not need to use both- just use one. Alternative method: Explain. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines. Total The Power The Accelerator The Balanced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts