Question: Please show work!!! Chapter 9 Assignment Foreign Currency Transactions and Hedging Foreign Exchange Risk Advance Accounting (12 points) Edmond Company (a U.S.-based company) sold farm

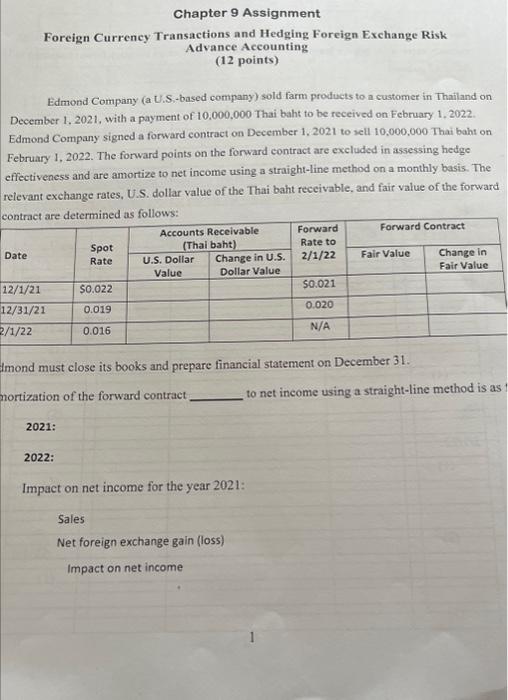

Chapter 9 Assignment Foreign Currency Transactions and Hedging Foreign Exchange Risk Advance Accounting (12 points) Edmond Company (a U.S.-based company) sold farm products to a customer in Thailand on December 1.2021, with a payment of 10,000,000 Thai baht to be received on February 1, 2022. Edmond Company signed a forward contract on December 1,2021 to sell 10,000,000 Thai baht on February 1, 2022. The forward points on the forward contract are excluded in assessing hedge effectiveness and are amortize to net income using a straight-line method on a monthly basis. The relevant exchange rates, U.S. dollar value of the Thai baht reccivable, and fair value of the forward Imond must close its books and prepare financial statement on December 31 . nortization of the forward contract to net income using a straight-line method is as 2021: 2022: Impact on net income for the year 2021: Sales Net foreign exchange gain (loss) Impact on net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts