Question: Please show work Choice Chicken grows and processes chickens. Each chicken is disassembled into five main parts. Information pertaining to production in July 2017 is

Please show work

Please show work

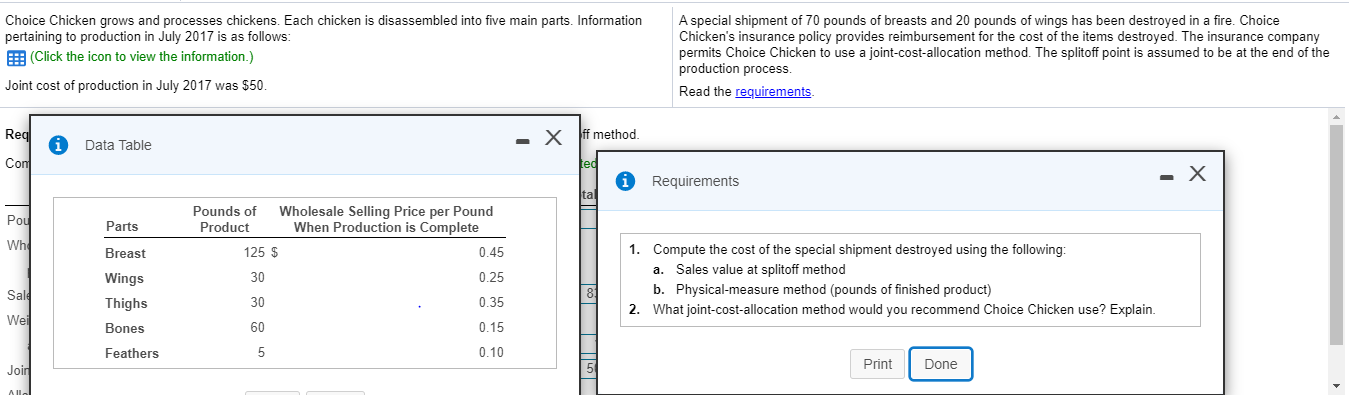

Choice Chicken grows and processes chickens. Each chicken is disassembled into five main parts. Information pertaining to production in July 2017 is as follows: (Click the icon to view the information.) A special shipment of 70 pounds of breasts and 20 pounds of wings has been destroyed in a fire. Choice Chicken's insurance policy provides reimbursement for the cost of the items destroyed. The insurance company permits Choice Chicken to use a joint-cost-allocation method. The splitoff point is assumed to be at the end of the production process. Read the requirements Joint cost of production in July 2017 was $50. Red xif method. Data Table Con Requirements x Pou Parts Pounds of Product Wholesale Selling Price per Pound When Production is Complete Wh Breast 125 $ 0.45 30 0.25 1. Compute the cost of the special shipment destroyed using the following: a. Sales value at splitoff method b. Physical-measure method (pounds of finished product) 2. What joint-cost-allocation method would you recommend Choice Chicken use? Explain. 30 0.35 Wings Thighs Bones Feathers Sale Wei 60 0.15 5 0.10 1 Joir Print Done All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts