Question: please show work D Question 19 Deep Mines has paid a dividend of $1.68 on its common stock per share and expected to increase the

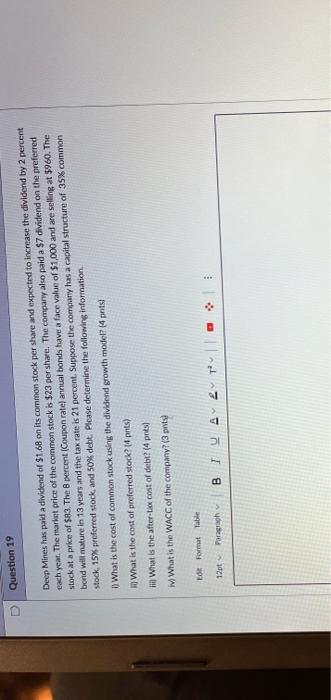

D Question 19 Deep Mines has paid a dividend of $1.68 on its common stock per share and expected to increase the dividend by 2 percent each year. The market price of the common stock is $23 per share. The company also paid a $7 dividend on the preferred stock at a price of $83. The 8 percent (Coupon rate) annual bonds have a face value of $1,000 and are selling at $960. The bond will mature in 13 years and the tax rate is 21 percent. Suppose the company has a capital structure of 35% common stock, 15% preferred stock, and 50% debt. Please determine the following information i) What is the cost of common stock using the dividend growth model? (4 pts) What is the cost of preferred stock? (4 pnts) What is the after-tax cost of debt? (4 pts) iv) What is the WACC of the company? (3 pnt) Edit Format Table 12pt Paragraph BIUA 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts