Question: Please show work Debt and debt markets Ace Publishing Ltd needs to borrow money for the purpose of purchasing a factory to expand its business.

Please show work

Please show work

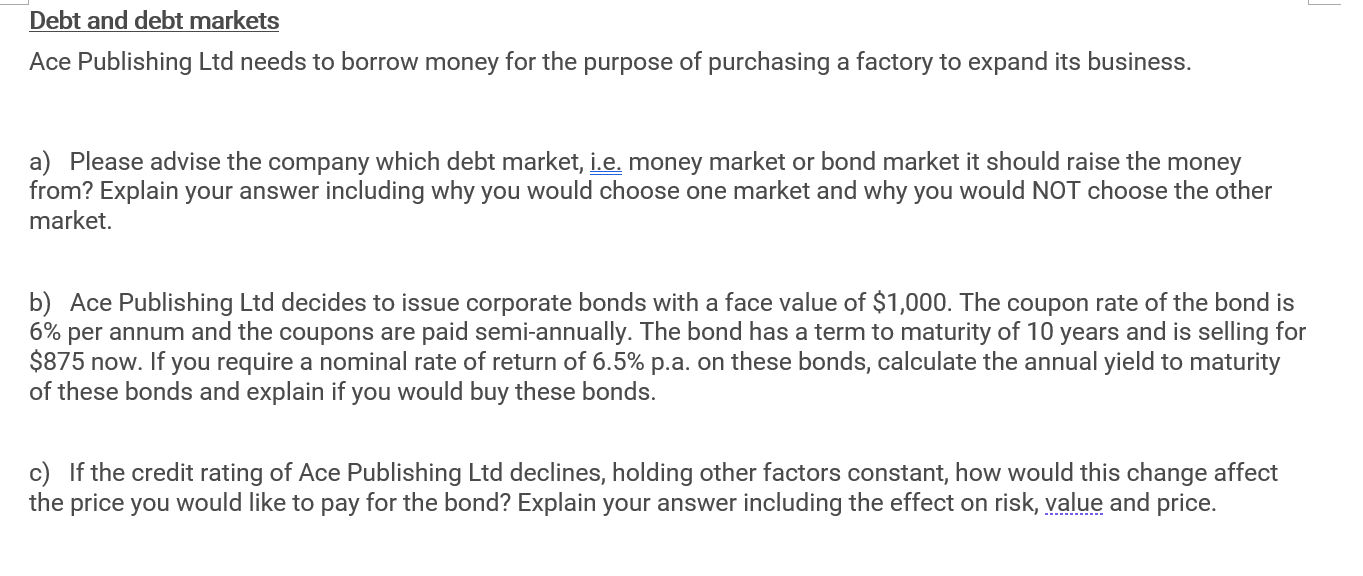

Debt and debt markets Ace Publishing Ltd needs to borrow money for the purpose of purchasing a factory to expand its business. a) Please advise the company which debt market, i.e. money market or bond market it should raise the money from? Explain your answer including why you would choose one market and why you would NOT choose the other market. b) Ace Publishing Ltd decides to issue corporate bonds with a face value of $1,000. The coupon rate of the bond is 6% per annum and the coupons are paid semi-annually. The bond has a term to maturity of 10 years and is selling for $875 now. If you require a nominal rate of return of 6.5% p.a. on these bonds, calculate the annual yield to maturity of these bonds and explain if you would buy these bonds. c) If the credit rating of Ace Publishing Ltd declines, holding other factors constant, how would this change affect the price you would like to pay for the bond? Explain your answer including the effect on risk, value and price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts