Question: Please show work Evaluate your selected bonds by performing the following calculations. Note: Prices are quoted in dollars /$100Par, so feel free to make the

Please show work

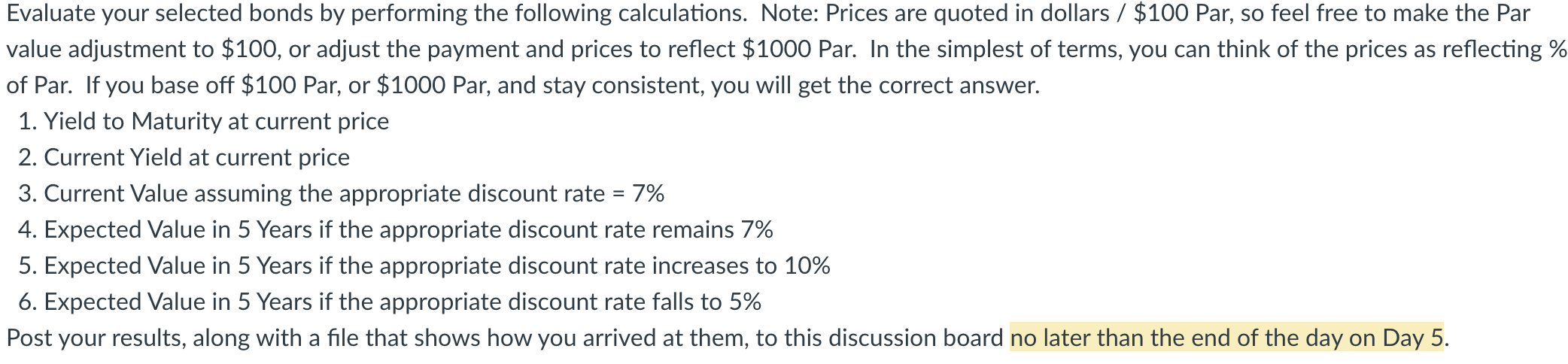

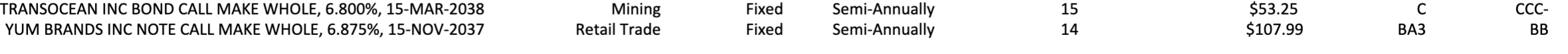

Evaluate your selected bonds by performing the following calculations. Note: Prices are quoted in dollars /$100Par, so feel free to make the Par value adjustment to $100, or adjust the payment and prices to reflect $1000 Par. In the simplest of terms, you can think of the prices as reflecting of Par. If you base off $100 Par, or $1000 Par, and stay consistent, you will get the correct answer. 1. Yield to Maturity at current price 2. Current Yield at current price 3. Current Value assuming the appropriate discount rate =7% 4. Expected Value in 5 Years if the appropriate discount rate remains 7% 5. Expected Value in 5 Years if the appropriate discount rate increases to 10% 6. Expected Value in 5 Years if the appropriate discount rate falls to 5% Post your results, along with a file that shows how you arrived at them, to this discussion board no later than the end of the day on Day 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts