Question: Please show work Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Vahe Weighted Average Cost of Capital

Please show work

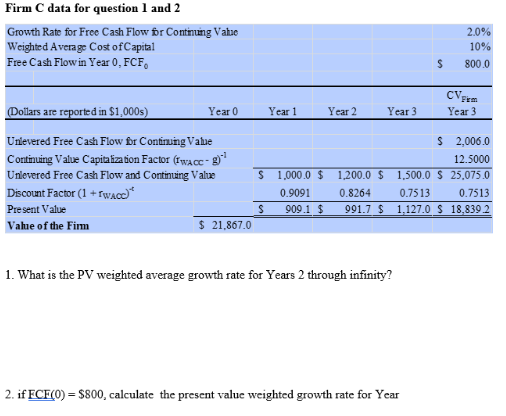

Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Vahe Weighted Average Cost of Capital Free Cash Flow in Year 0, FCF 2.0% 10% 800.0 $ CV Year 3 Year 1 Year 2 Year 3 (Dollars are reported in $1,000s) Year O Unlevered Free Cash Flow br Continuing Vahe Continuang Value Capitalization Factor (Kwacc- 9 Unlevered Free Cash Flow and Continuing Value Discount Factor (1 + wace) Present Value Value of the Fim $ 21,867.0 S 1.000.0 $ 0.9091 909.1 $ 1,200.0 $ 0.8264 991.7 $ $ 2,006.0 12.5000 1,500.0 S 25.075.0 0.7513 0.7513 1.127.0 S 18,839 2 S 1. What is the PV weighted average growth rate for Years 2 through infinity? 2. if FCF(O) = $800, calculate the present value weighted growth rate for Year Firm C data for question 1 and 2 Growth Rate for Free Cash Flow for Continuing Vahe Weighted Average Cost of Capital Free Cash Flow in Year 0, FCF 2.0% 10% 800.0 $ CV Year 3 Year 1 Year 2 Year 3 (Dollars are reported in $1,000s) Year O Unlevered Free Cash Flow br Continuing Vahe Continuang Value Capitalization Factor (Kwacc- 9 Unlevered Free Cash Flow and Continuing Value Discount Factor (1 + wace) Present Value Value of the Fim $ 21,867.0 S 1.000.0 $ 0.9091 909.1 $ 1,200.0 $ 0.8264 991.7 $ $ 2,006.0 12.5000 1,500.0 S 25.075.0 0.7513 0.7513 1.127.0 S 18,839 2 S 1. What is the PV weighted average growth rate for Years 2 through infinity? 2. if FCF(O) = $800, calculate the present value weighted growth rate for Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts