Question: please show work for both. thumbs up if correct. (Using degree of operating leverage) Last year Baker Huggy Inc. had fixed costs of $170,000 and

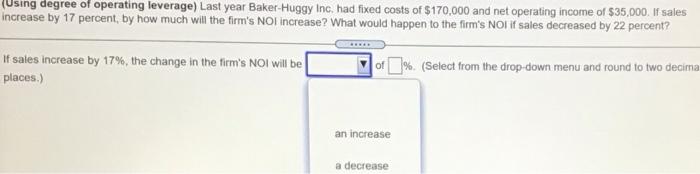

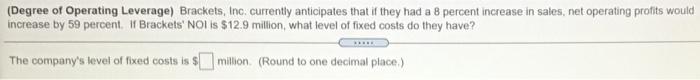

(Using degree of operating leverage) Last year Baker Huggy Inc. had fixed costs of $170,000 and net operating income of $35,000. If sales increase by 17 percent, by how much will the firm's NOT increase? What would happen to the firm's NOI if sales decreased by 22 percent? of sales increase by 17%, the change in the firm's NOI will be places.) of %. (Select from the drop-down menu and round to two decima an increase a decrease (Degree of Operating Leverage) Brackets, Inc. currently anticipates that if they had a 8 percent increase in sales, net operating profits would increase by 59 percent of Brackets' NOI is $12.9 million, what level of fixed costs do they have? The company's level of fixed costs is $ millon (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts