Question: please show work for correct answer, thank you. A firm has just paid (the moment before valuation) a dividend of 88c and is expected to

please show work for correct answer, thank you.

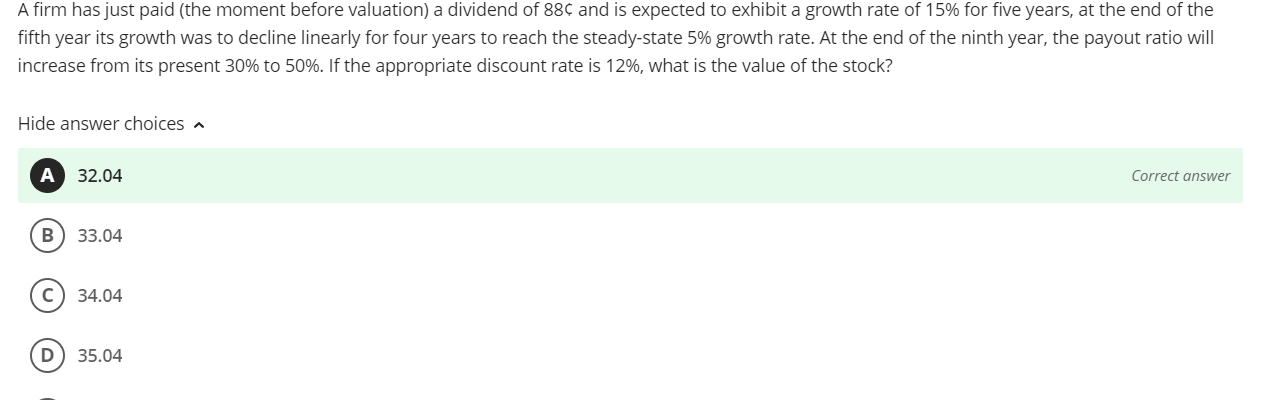

A firm has just paid (the moment before valuation) a dividend of 88c and is expected to exhibit a growth rate of 15% for five years, at the end of the fifth year its growth was to decline linearly for four years to reach the steady-state 5% growth rate. At the end of the ninth year, the payout ratio will increase from its present 30% to 50%. If the appropriate discount rate is 12%, what is the value of the stock? Hide answer choices a A 32.04 Correct answer B 33.04 34.04 D) 35.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts