Question: Please show work for correct answer thanks so much! In year B. Pellinore Co. buys some of the outstanding bonds of its subsidiary Sagramore Co.

Please show work for correct answer thanks so much!

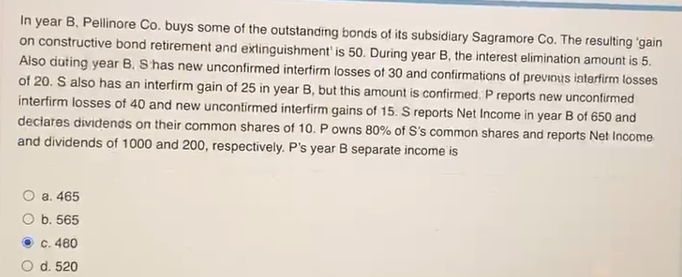

In year B. Pellinore Co. buys some of the outstanding bonds of its subsidiary Sagramore Co. The resulting 'gain on constructive bond retirement and extinguishment' is 50. During year B, the interest elimination amount is 5. Also cuting year B. S has new unconfirmed interfirm losses of 30 and confirmations of previous ialarfirm losses of 20. S also has an interfirm gain of 25 in year B, but this amount is confirmed. P reports new unconfirmed interfirm losses of 40 and new uncontirmed interfirm gains of 15. S reports Net Income in year B of 650 and declares dividends on their common shares of 10. P owns 80% of S's common shares and reports Net Income and dividends of 1000 and 200, respectively. P's year B separate income is a. 465 b. 565 c. 480 O d. 520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts