Question: Please show work for each question in depth 1. LeAnn Sands wants to conduct operating breakeven analyses of the Salza Technology Corporation for year 2019.

Please show work for each question in depth

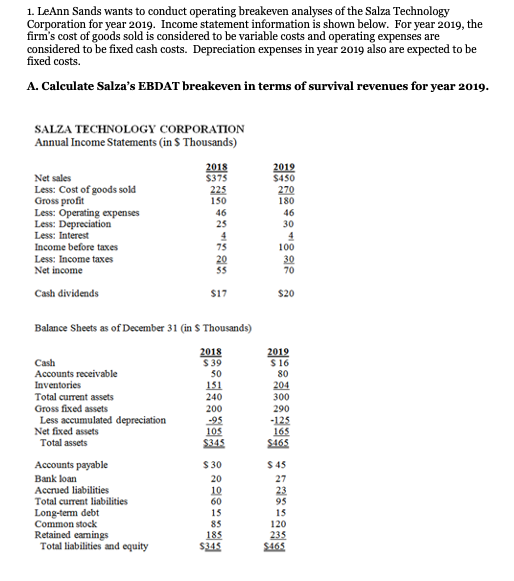

1. LeAnn Sands wants to conduct operating breakeven analyses of the Salza Technology Corporation for year 2019. Income statement information is shown below. For year 2019, the firm's cost of goods sold is considered to be variable costs and operating expenses are considered to be fixed cash costs. Depreciation expenses in year 2019 also are expected to be fixed costs. A. Calculate Salza's EBDAT breakeven in terms of survival revenues for year 2019. SALZA TECHNOLOGY CORPORATION Annual Income Statements in $ Thousands) 2018 $375 225 150 46 25 4 75 20 55 2019 $450 270 180 46 Net sales Less: Cost of goods sold Gross profit Less: Operating expenses Less: Depreciation Less: Interest Income before taxes Less: Income taxes Net income 30 100 30 70 Cash dividends $17 $20 $ 39 Balance Sheets as of December 31 (in S Thousands) 2018 Cash Accounts receivable 50 Inventories 151 Total current assets 240 Gross fixed assets 200 Less accumulated depreciation -95 Net fixed assets 105 Total assets $345 2019 $ 16 80 204 300 290 -125 165 $465 Accounts payable Bank loan Accrued liabilities Total current liabilities Long-term debt Common stock Retained eamings Total liabilities and equity $ 30 20 10 60 15 85 185 $345 $ 45 27 23 95 15 120 235 $465 2. LeAnn Sands has reason to believe that year 2020 will be a replication of year 2019 except that cost of goods sold are expected to be 65 percent of the estimated $450,000 in revenues. Other income statement relationships are expected to remain the same in year 2020 as they were in year 2019. A. Calculate the EBDAT breakeven point for 2020 for Salza in terms of survival revenues. 1. LeAnn Sands wants to conduct operating breakeven analyses of the Salza Technology Corporation for year 2019. Income statement information is shown below. For year 2019, the firm's cost of goods sold is considered to be variable costs and operating expenses are considered to be fixed cash costs. Depreciation expenses in year 2019 also are expected to be fixed costs. A. Calculate Salza's EBDAT breakeven in terms of survival revenues for year 2019. SALZA TECHNOLOGY CORPORATION Annual Income Statements in $ Thousands) 2018 $375 225 150 46 25 4 75 20 55 2019 $450 270 180 46 Net sales Less: Cost of goods sold Gross profit Less: Operating expenses Less: Depreciation Less: Interest Income before taxes Less: Income taxes Net income 30 100 30 70 Cash dividends $17 $20 $ 39 Balance Sheets as of December 31 (in S Thousands) 2018 Cash Accounts receivable 50 Inventories 151 Total current assets 240 Gross fixed assets 200 Less accumulated depreciation -95 Net fixed assets 105 Total assets $345 2019 $ 16 80 204 300 290 -125 165 $465 Accounts payable Bank loan Accrued liabilities Total current liabilities Long-term debt Common stock Retained eamings Total liabilities and equity $ 30 20 10 60 15 85 185 $345 $ 45 27 23 95 15 120 235 $465 2. LeAnn Sands has reason to believe that year 2020 will be a replication of year 2019 except that cost of goods sold are expected to be 65 percent of the estimated $450,000 in revenues. Other income statement relationships are expected to remain the same in year 2020 as they were in year 2019. A. Calculate the EBDAT breakeven point for 2020 for Salza in terms of survival revenues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts