Question: please show work for each step and i will upvote have correct answers. Required information The following information applies to the questions displayed below) Jeremy

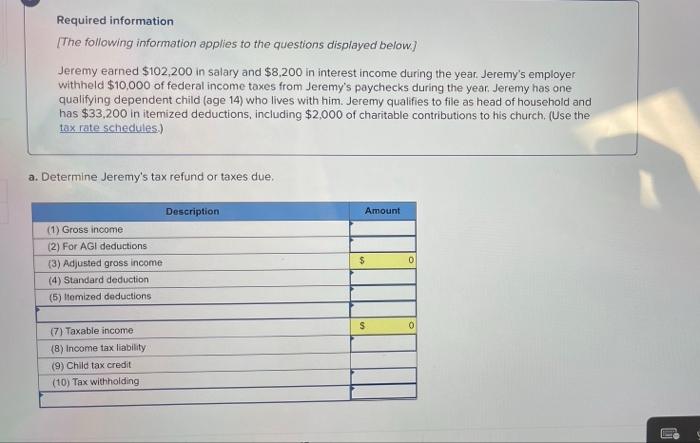

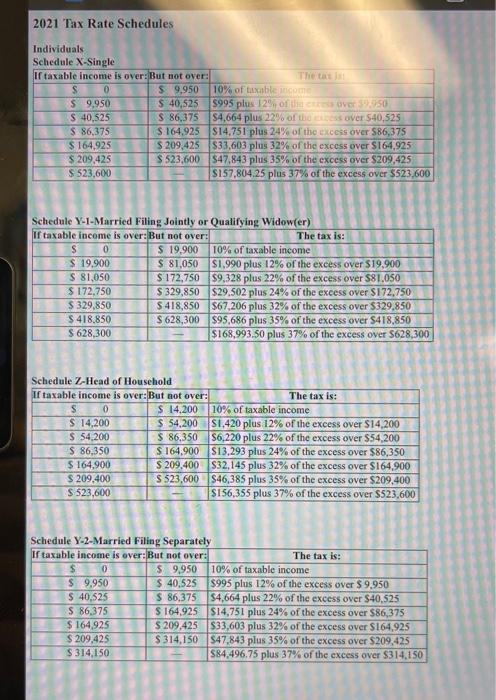

Required information The following information applies to the questions displayed below) Jeremy earned $102,200 in salary and $8,200 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $33,200 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules) a. Determine Jeremy's tax refund or taxes due. Amount Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itomized deductions $ 0 $ 0 (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding ES 2021 Tax Rate Schedules Individuals Schedule X-Single Ir taxable income is over: But not over: S 0 $9.950 10% of taxable incom $ 9,950 $ 40,525 S995 plus 12% of the S 40,525 S 86,375 S4,664 plus 22% of the over $40,525 $ 86,375 $164.925 $14.751 plus 24% of the excess over $86,375 $164.925 $ 209,425 $33,603 plus 32% of the excess over $164.925 $ 209,425 $ 523,600 47,843 plus 35% of the excess over $209,425 $ 523,600 S157.804.25 plus 37% of the excess over 5523.600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,900 10% of taxable income S 19.900 $ 81,050 S1.990 plus 12% of the excess over $19.900 S 81,050 $ 172,750 $9,328 plus 22% of the excess over $81.050 S 172.750 $ 329,850 $29.502 plus 24% of the excess over $172.750 $ 329,850 S418,850 $67,206 plus 32% of the excess over $329,850 S 418,850 $ 628,300 $95,686 plus 35% of the excess over $418,850 S 628,300 $168.993.50 plus 37% of the excess over 5628,300 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: S 0 S 14.200 10% of taxable income $ 14,200 S 54,200 S1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 S6.220 plus 22% of the excess over $54,200 $ 86,350 S 164.900 $13,293 plus 24% of the excess over $86,350 $ 164,900 S 209,400 $32,145 plus 32% of the excess over $164.900 $ 209,400 S 523,600 S46,385 plus 35% of the excess over $209,400 S 523,600 $156,355 plus 37% of the excess over S523,600 Schedule Y-2-Married Filing Separately Ir taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $9.950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40.525 S 86,375 S 164.925 $14.751 plus 24% of the excess over $86,375 $164.925 $ 209.425 $33,603 plus 32% of the excess over $164.925 $ 209,425 $ 314,150 $47.843 plus 35% of the excess over $209,425 S 314,150 S84,496.75 plus 37% of the excess over $314,150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts