Question: Please show work for each step by placing it into the column to the right of cash flow. Thank you! 5. (10 points) Please finish

Please show work for each step by placing it into the column to the right of cash flow.

Thank you!

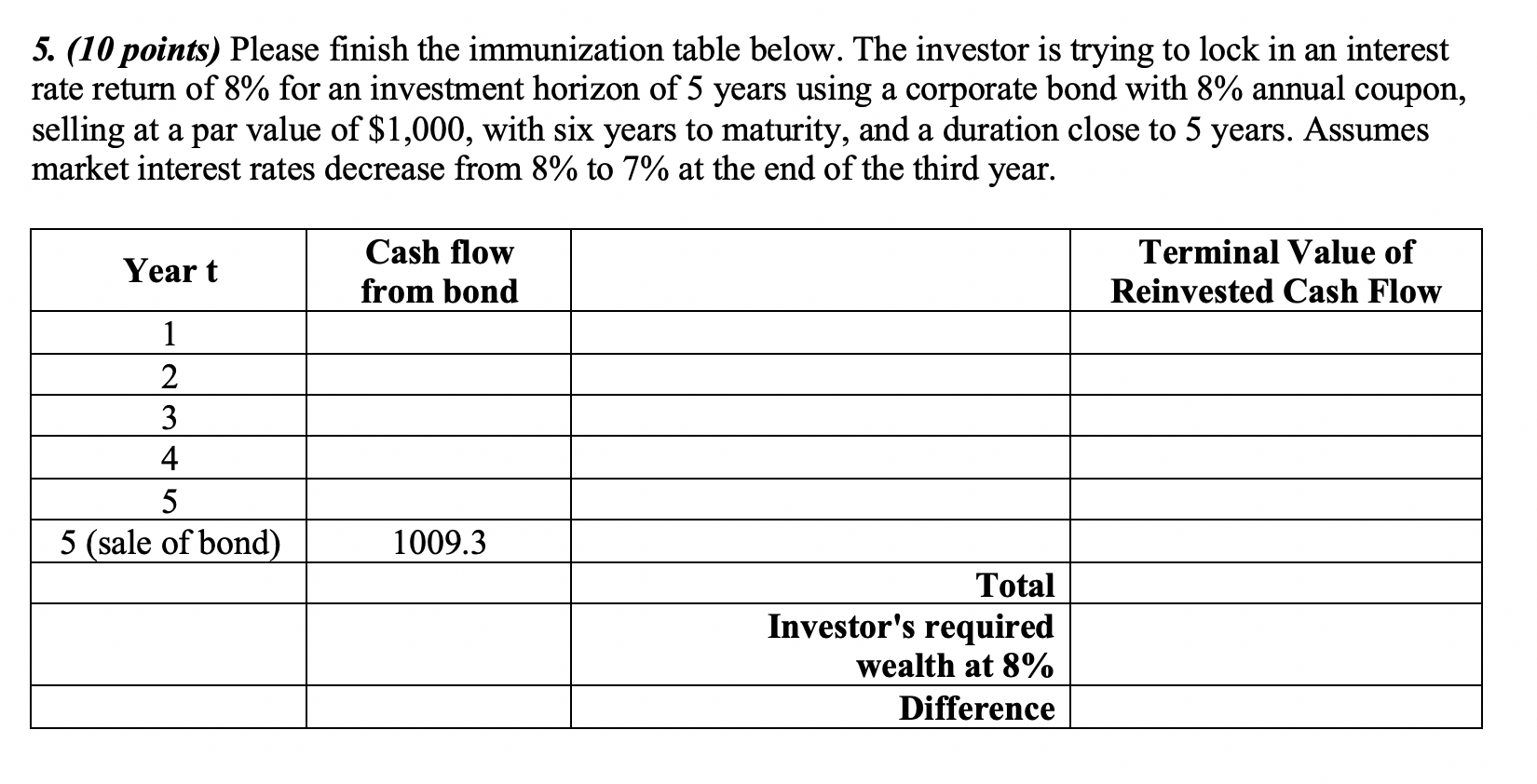

5. (10 points) Please finish the immunization table below. The investor is trying to lock in an interest rate return of 8% for an investment horizon of 5 years using a corporate bond with 8% annual coupon, selling at a par value of $1,000, with six years to maturity, and a duration close to 5 years. Assumes market interest rates decrease from 8% to 7% at the end of the third year. Yeart Cash flow from bond Terminal Value of Reinvested Cash Flow 1 2 3 4 5 5 (sale of bond) 1009.3 Total Investor's required wealth at 8% Difference 5. (10 points) Please finish the immunization table below. The investor is trying to lock in an interest rate return of 8% for an investment horizon of 5 years using a corporate bond with 8% annual coupon, selling at a par value of $1,000, with six years to maturity, and a duration close to 5 years. Assumes market interest rates decrease from 8% to 7% at the end of the third year. Yeart Cash flow from bond Terminal Value of Reinvested Cash Flow 1 2 3 4 5 5 (sale of bond) 1009.3 Total Investor's required wealth at 8% Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts