Question: Please show work for this. Thank you Question 3. (5 points) Roll ns Corporation is estimating its WACC. Its target capital structure composed of $

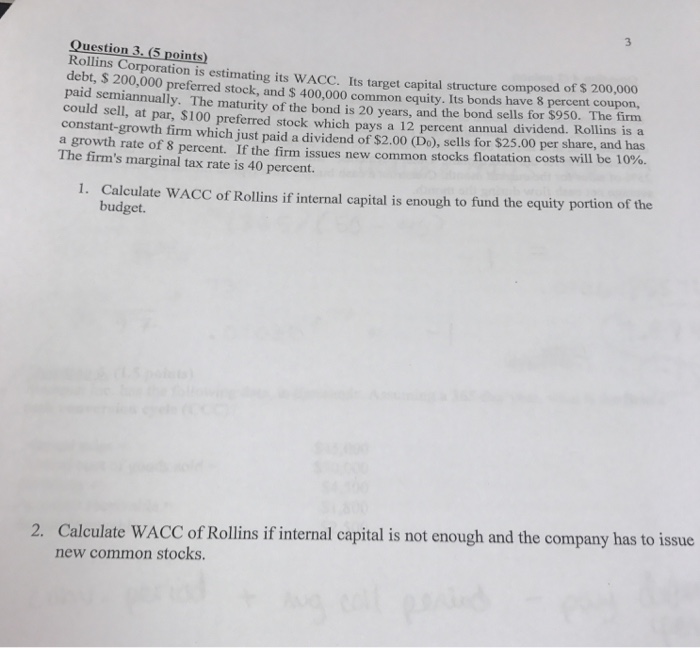

Question 3. (5 points) Roll ns Corporation is estimating its WACC. Its target capital structure composed of $ 200,000 debt, S 200,000 preferred stock, and $ 400,000 common equity. Its bonds have 8 percent coupon, paid semiannually. The maturity of the bond is 20 years, and the bond sells for $950. The firm could sell, at par, $100 preferred stock which pays a 12 percent annual dividend. Rollins is a constant-growth firm which just paid a dividend of $2.00 (Do), sells for $25.00 per share, and has a growth rate of 8 percent. If the firm issues new common stocks floatation costs wi The firm's marginal tax rate is 40 percent. ll be 10%. 1. Calculate WACC of Rollins if internal capital is enough to fund the equity portion of the budget. Calculate WACC of Rollins if internal capital is not enough and the company has to issue new common stocks. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts