Question: please show work for thumbs up:) A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and

please show work for thumbs up:)

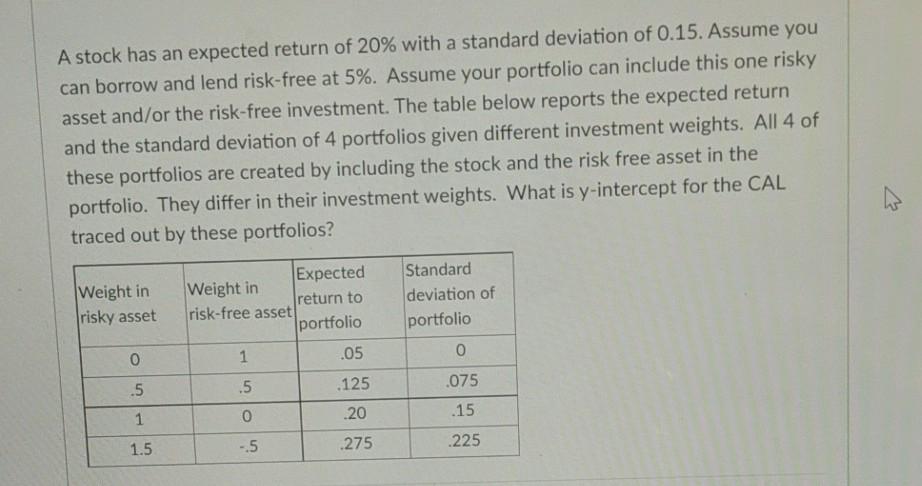

A stock has an expected return of 20% with a standard deviation of 0.15. Assume you can borrow and lend risk-free at 5%. Assume your portfolio can include this one risky asset and/or the risk-free investment. The table below reports the expected return and the standard deviation of 4 portfolios given different investment weights. All 4 of these portfolios are created by including the stock and the risk free asset in the portfolio. They differ in their investment weights. What is y-intercept for the CAL traced out by these portfolios? Weight in risky asset Expected Weight in return to risk-free asset portfolio 1 .05 Standard deviation of portfolio 0 0 .5 .5 .125 .075 1 o .20 .15 1.5 --5 .275 .225

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts