Question: please show work Help Save Required information Problem 6-5A Calculate ending inventory and cost of goods sold using FIFO and LIFO and adjust inventory using

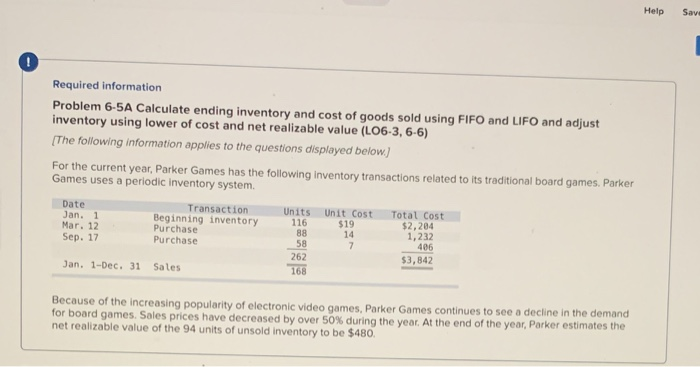

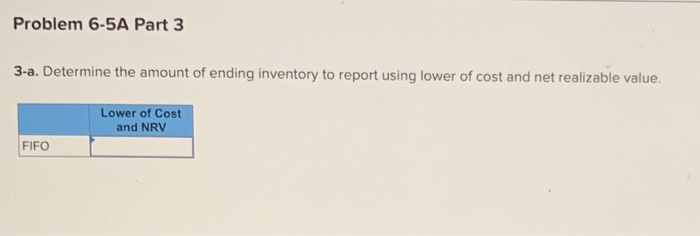

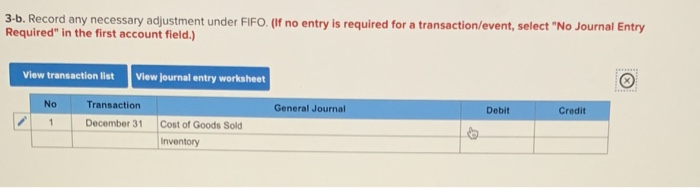

Help Save Required information Problem 6-5A Calculate ending inventory and cost of goods sold using FIFO and LIFO and adjust inventory using lower of cost and net realizable value (L06-3, 6-6) [The following information applies to the questions displayed below) For the current year, Parker Games has the following inventory transactions related to its traditional board games. Parker Games uses a periodic inventory system. Date Transaction Units Unit Cost Total Cost Jan. 1 Beginning inventory $19 Mar. 12 Purchase $2,204 14 Sep. 17 Purchase 1,232 7 406 262 $3,842 Jan. 1-Dec. 31 Sales 168 116 88 58 Because of the increasing popularity of electronic video games, Parker Games continues to see a decline in the demand for board games. Sales prices have decreased by over 50% during the year. At the end of the year, Parker estimates the net realizable value of the 94 units of unsold inventory to be $480. Problem 6-5A Part 3 3-a. Determine the amount of ending inventory to report using lower of cost and net realizable value. Lower of Cost and NRV FIFO 3-b. Record any necessary adjustment under FIFO. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View Journal entry worksheet No Transaction December 31 Cost of Goods Sold Inventory General Journal Debit Credit 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts