Question: Please show work. I am assuming that the graphs on 2.2.2 need to be drawn out to show equity and debt using these notes he

Please show work.

I am assuming that the graphs on 2.2.2 need to be drawn out to show equity and debt using these notes he provided. I am as confused with the question myself.

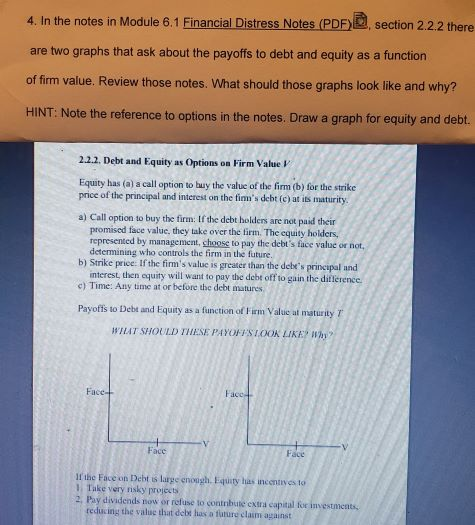

4. In the notes in Module 6.1 Financial Distress Notes (PDF) section 2.2.2 there are two graphs that ask about the payoffs to debt and equity as a function of firm value. Review those notes. What should those graphs look like and why? HINT: Note the reference to options in the notes. Draw a graph for equity and debt. 2.2.2. Debt and Equity as Options on Firm Value Equity has (a) a call option to buy the value of the firm (b) for the strike price of the principal and interest on the tim's debt (c) at its maturity. a) Call option to buy the firm: If the debt holders are not paid their promised face value, they take over the firm. The equity holders, represented by management, choose to pay the debt's face value or not, determining who controls the firm in the future, b) Strike price. If the firm's value is greater than the dele's principal and interest, then equity will want to pay the debt off to gain the difference. c) Time: Any time at or before the debt matures Payoffs to Debt and Equity as a function of Firm Value al maturity WHAT SHOULD THESE PAYOFFSTOOK LIKE Why Face- Facet Face Face If the Face on Debt is large enough. Equity has incentives to 1 Take very risky project 2. Pay dividends now or refuse to contribute extra capital for investments reducing the value that debt has a future claim against 4. In the notes in Module 6.1 Financial Distress Notes (PDF) section 2.2.2 there are two graphs that ask about the payoffs to debt and equity as a function of firm value. Review those notes. What should those graphs look like and why? HINT: Note the reference to options in the notes. Draw a graph for equity and debt. 2.2.2. Debt and Equity as Options on Firm Value Equity has (a) a call option to buy the value of the firm (b) for the strike price of the principal and interest on the tim's debt (c) at its maturity. a) Call option to buy the firm: If the debt holders are not paid their promised face value, they take over the firm. The equity holders, represented by management, choose to pay the debt's face value or not, determining who controls the firm in the future, b) Strike price. If the firm's value is greater than the dele's principal and interest, then equity will want to pay the debt off to gain the difference. c) Time: Any time at or before the debt matures Payoffs to Debt and Equity as a function of Firm Value al maturity WHAT SHOULD THESE PAYOFFSTOOK LIKE Why Face- Facet Face Face If the Face on Debt is large enough. Equity has incentives to 1 Take very risky project 2. Pay dividends now or refuse to contribute extra capital for investments reducing the value that debt has a future claim against

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts