Question: Please SHOW WORK! I need someone with actual financial knowledge who knows what they are talking about, please. I can't find this question on Chegg

Please SHOW WORK! I need someone with actual financial knowledge who knows what they are talking about, please. I can't find this question on Chegg so you can't copy another answer. And if you do, there will be hell to pay. Thank you for your help.

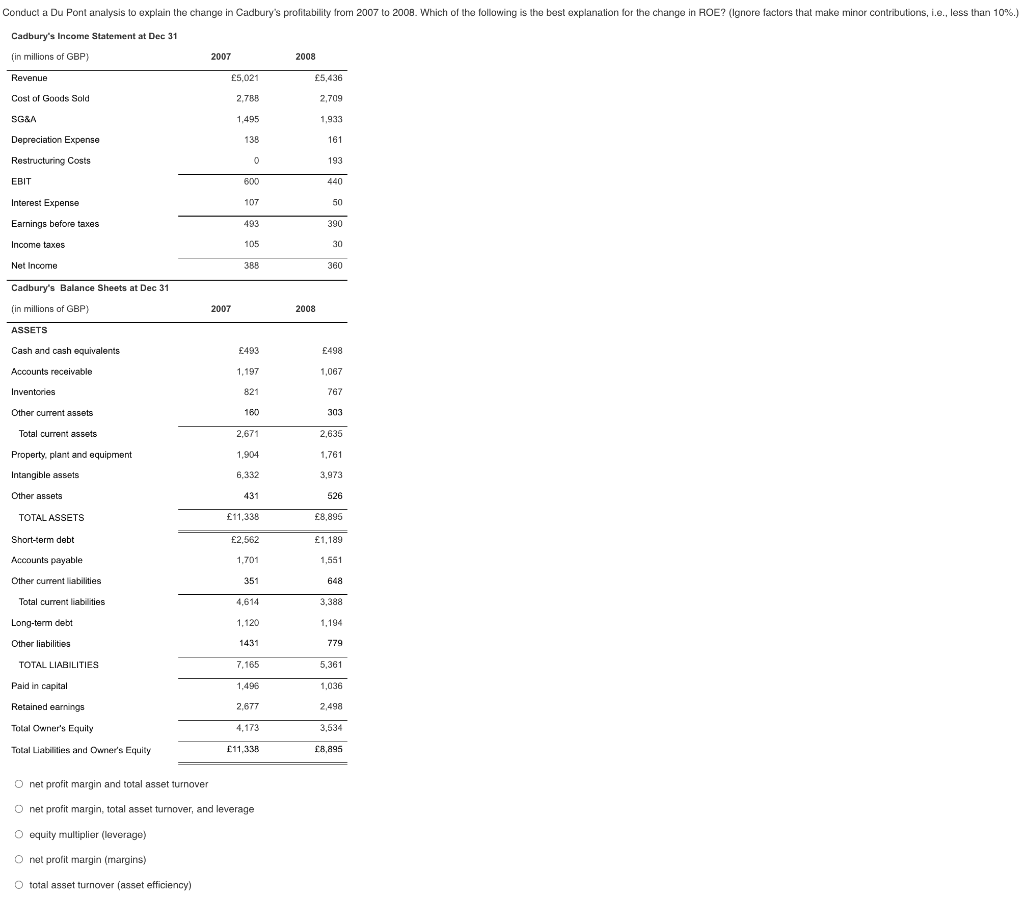

Conducl a Du Pont analysis to explain the change in Cadbury's profilability from 2007 to 2008. Which of the following is the best explanation for the change in ROE? (Ignore factors that make minor contributions, i.e., less than 10%.) Cadbury's Income Statement at Dec 31 (in Millions of GBP) 2007 2008 Revenue 5,021 5,436 Cost of Goods Sold 2,785 2,709 SG&A 1,495 1,933 Depreciation Expense 138 161 Restructuring Costs 0 193 EBIT 600 440 Interest Expense 107 50 Earnings before taxes 493 390 Income taxes 105 30 Net Income 388 360 Cadbury's Balance Sheets at Dec 31 (in millions of GBP) 2007 2008 ASSETS Cash and cash equivalents 493 498 Accounts receivable 1,197 1,067 Inventories 821 767 Other current assets 150 303 Total current assets 2,671 2,635 Property, plant and equipment 1,904 1,761 Intangible assets 6,332 3,973 Other assets 431 526 TOTAL ASSETS 11,338 8,895 Short-term debt 2,562 1,189 Accounts payable 1,701 1,551 Other current liabilities 351 648 Total current liabilities 4,614 3,388 Long-term debt 1,120 1,194 Other liabilities 1431 779 TOTAL LIABILITIES 7,165 5,361 Paid in capital 1,496 1,036 Retained earnings 2,677 2.498 Total Owner's Equity 4,173 3,534 Total Liabilities and Owner's Equity [11.338 8,895 O net profit margin and total asset turnover O net profit margin, total asset turnover, and leverage O equily multiplier (leverage) O net profit margin (margins) O total asset turnover (asset efficiency)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts