Question: Please show work! Identifying and Analyzing Financial Statement Effects of Stock Transactions The stockholders' equity of Verrecchia Company at December 31, 2011, follows: Common stock,

Please show work!

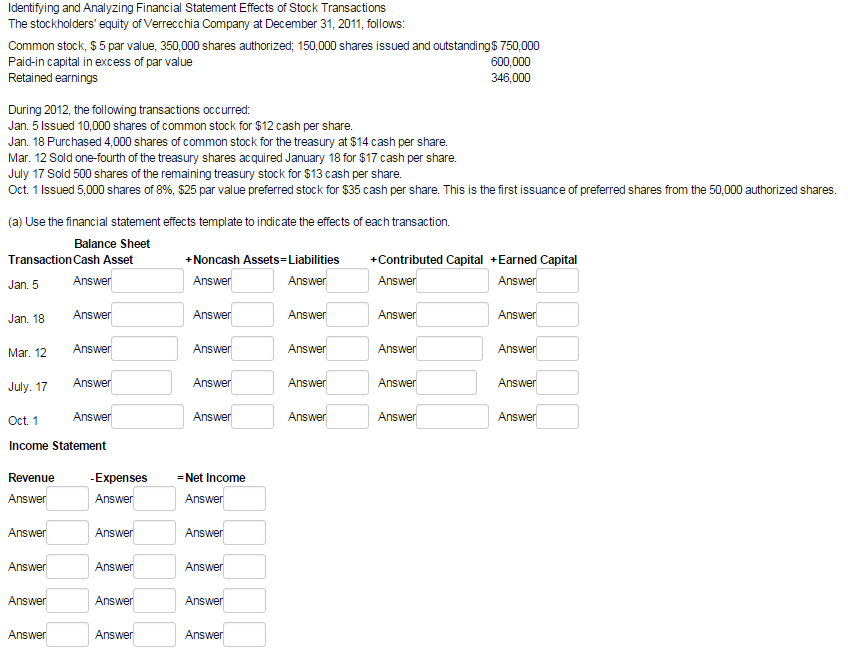

Identifying and Analyzing Financial Statement Effects of Stock Transactions The stockholders' equity of Verrecchia Company at December 31, 2011, follows: Common stock, exist 5 par value, 350,000 shares authorized: 150,000 shares issued and outstandingexist 750,000 Paid-in capital in excess of par value 600,000 Retained earnings 346,000 During 2012, the following transactions occurred: Jan. 5 Issued 10,000 shares of common stock for exist12 cash per share. Jan. 18 Purchased 4,000 shares of common stock for the treasury at exist14 cash per share. Mar. 12 Sold one-fourth of the treasury shares acquired January 18 for exist17 cash per share. July 17 Sold 500 shares of the remaining treasury stock for exist13 cash per share. Oct. 1 Issued 5,000 shares of 8%, exist25 par value preferred stock for exist35 cash per share. This is the first issuance of preferred shares from the 50,000 authorized shares. a) Use the financial statement effects template to indicate the effects of each transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts