Question: Please show work if possible. DEF Industries will pay a regular dividend of $3.35 per share for each of the next 5 years. At the

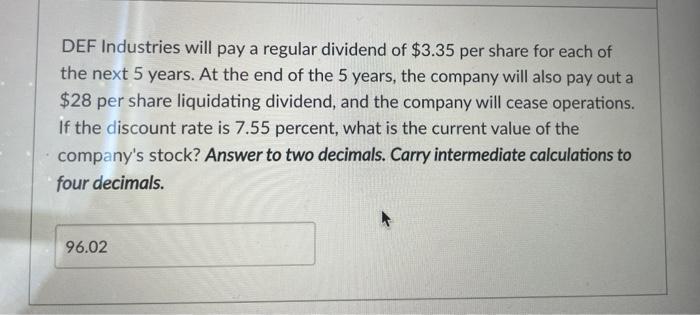

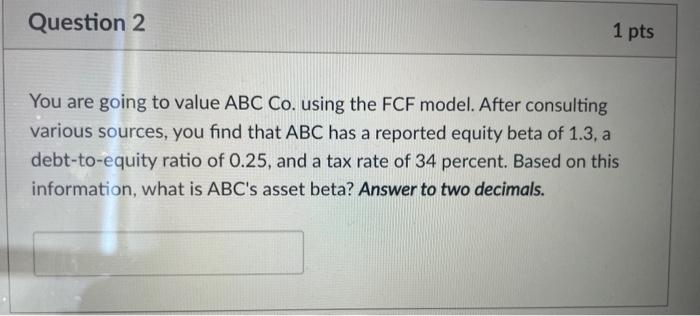

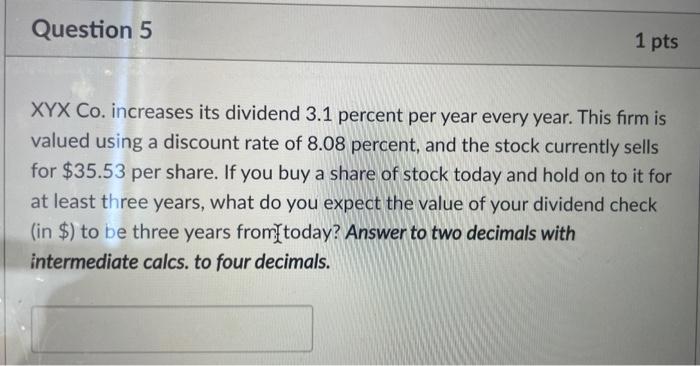

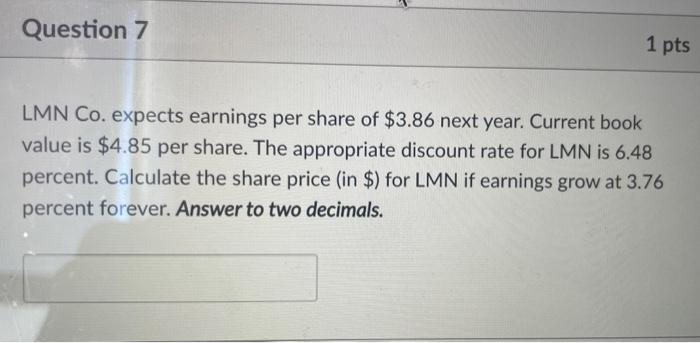

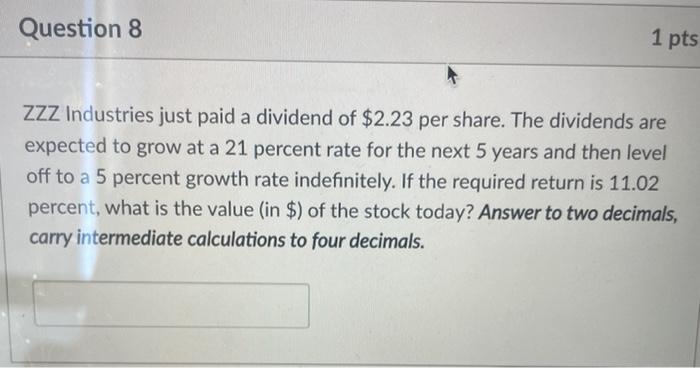

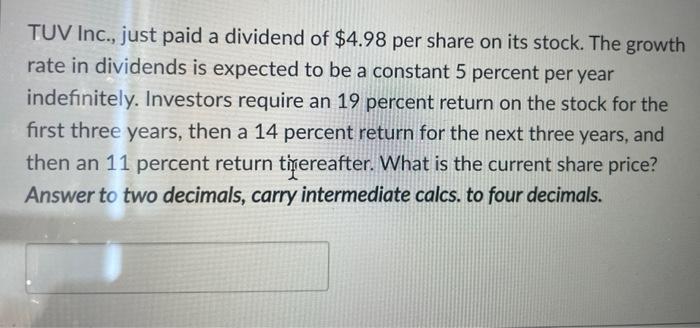

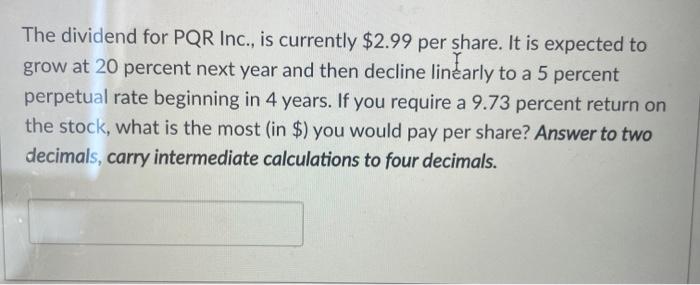

DEF Industries will pay a regular dividend of $3.35 per share for each of the next 5 years. At the end of the 5 years, the company will also pay out a $28 per share liquidating dividend, and the company will cease operations. If the discount rate is 7.55 percent, what is the current value of the company's stock? Answer to two decimals. Carry intermediate calculations to four decimals. 96.02 Question 2 1 pts You are going to value ABC Co. using the FCF model. After consulting various sources, you find that ABC has a reported equity beta of 1.3, a debt-to-equity ratio of 0.25, and a tax rate of 34 percent. Based on this information, what is ABC's asset beta? Answer to two decimals. Question 5 1 pts XYX Co. increases its dividend 3.1 percent per year every year. This firm is valued using a discount rate of 8.08 percent, and the stock currently sells for $35.53 per share. If you buy a share of stock today and hold on to it for at least three years, what do you expect the value of your dividend check (in $) to be three years from today? Answer to two decimals with intermediate calcs. to four decimals. Question 7 1 pts LMN Co. expects earnings per share of $3.86 next year. Current book value is $4.85 per share. The appropriate discount rate for LMN is 6.48 percent. Calculate the share price (in $) for LMN if earnings grow at 3.76 percent forever. Answer to two decimals. Question 8 1 pts ZZZ Industries just paid a dividend of $2.23 per share. The dividends are expected to grow at a 21 percent rate for the next 5 years and then level off to a 5 percent growth rate indefinitely. If the required return is 11.02 5 percent, what is the value (in $) of the stock today? Answer to two decimals, carry intermediate calculations to four decimals. TUV Inc., just paid a dividend of $4.98 per share on its stock. The growth rate in dividends is expected to be a constant 5 percent per year indefinitely. Investors require an 19 percent return on the stock for the first three years, then a 14 percent return for the next three years, and then an 11 percent return tirereafter. What is the current share price? Answer to two decimals, carry intermediate calcs. to four decimals. The dividend for PQR Inc., is currently $2.99 per share. It is expected to grow at 20 percent next year and then decline linarly to a 5 percent perpetual rate beginning in 4 years. If you require a 9.73 percent return on the stock, what is the most (in $) you would pay per share? Answer to two decimals, carry intermediate calculations to four decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts